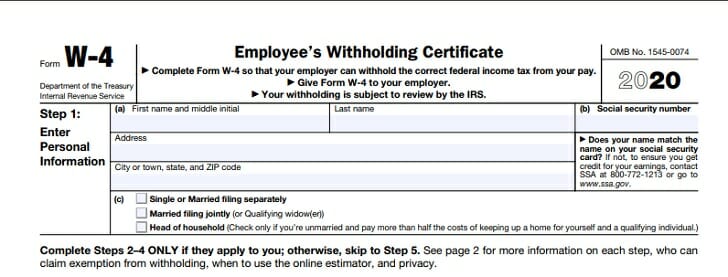

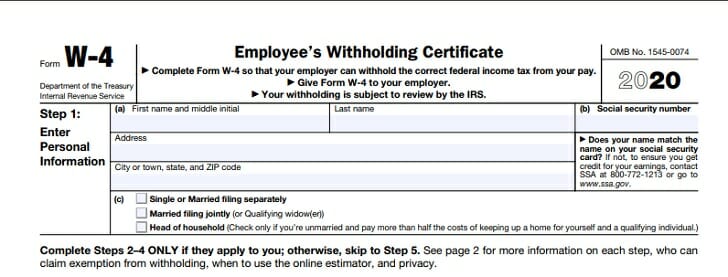

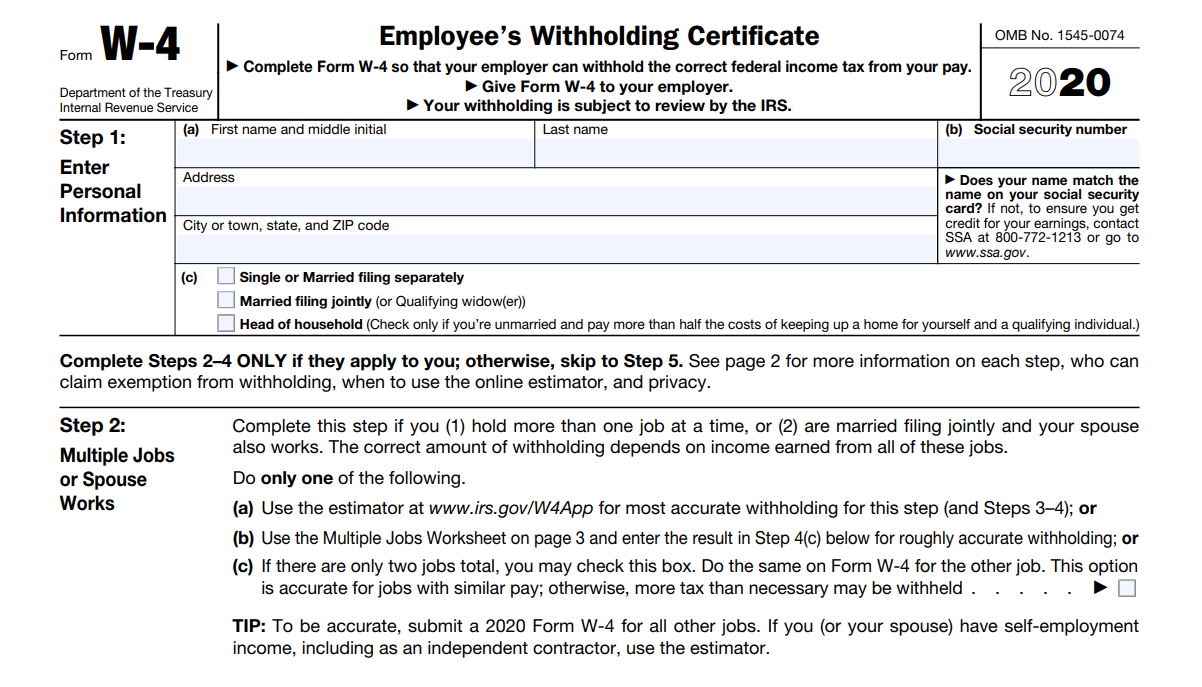

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Here is a link to the final form for reference.

Is everyone required to submit the new Form W-4.

Is there a new w 4 form for 2020. Employers may but are not required to distribute the 2020 Form W-4 to existing employees. Employers must use the form for all new hires beginning January 1. New W-4 Released for 2020.

The new IRS W-4 complements the. Employers will continue to compute withholding based on the information from the employees most recently submitted Form W-4. The form includes major revisions from the previous version.

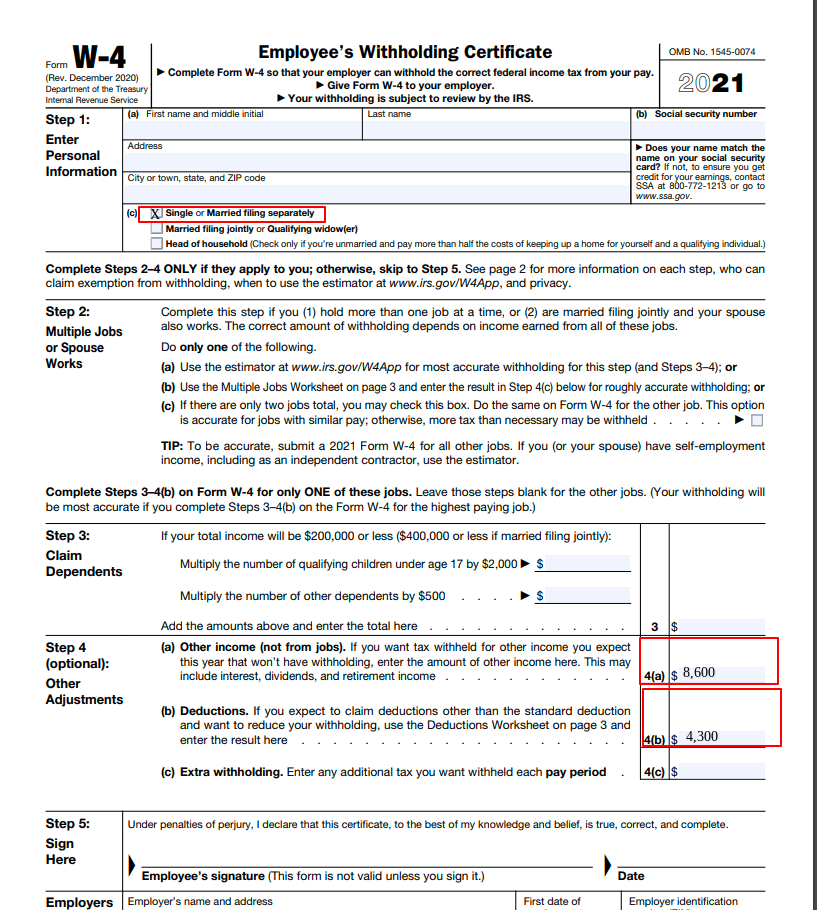

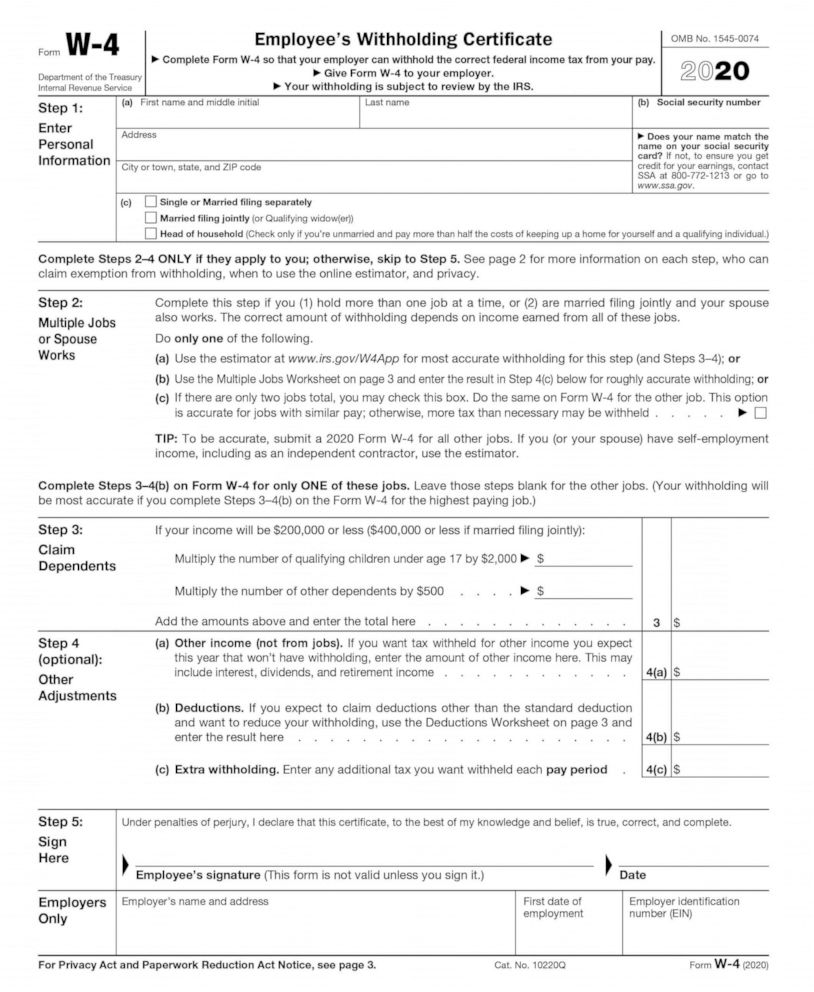

Same as the 2020 Form W-4 the 2021 Form W-4 has only two worksheets down from three on the 2019 form. If youre only familiar with the allowances on Form W-4 know that they have been removed for good. Give Form W-4 to your employer.

Employers must furnish the 2020 Form W-4 to newly hired employees after 2019. On December 5 2019 the IRS released the final version of the 2020 Form W-4. On December 5 the IRS issued the redesigned 2020 Form W-4 Employees Withholding Certificate.

In addition to the new Form W-4 the IRS also released a NEW Tax Withholding Estimator. One for the old. Updated 605 AM ET Sun January 5 2020 Washington CNN Theres a new federal income tax withholding form and a good reason to fill it out fresh this year.

Instead there is a five-step process and new Publication 15-T Federal Income Tax Withholding Methods for. Youre not the only one taking a new year new me approach to 2020. Now theres a 2020 W-4 form that completely revamps income tax withholding.

Employers will continue to compute withholding based on the information from the employees most recently furnished Form W-4. Existing employees dont have to complete a. Its the first major update to the form.

This calculator walks. 2020 is not an exception as the IRS issued the new W-4 Form that will be used to withhold tax this year. Form W-4 the official name for the Employees Withholding Certificate is a document workers fill out so their employers can determine how much federal income tax to deduct from their paychecks.

December 2020 Department of the Treasury Internal Revenue Service. Its time to unfurl the pomp and circumstance for the arrival of the new W-4. Your withholding is subject to review by the IRS.

Workers who have used Form W-4 in any year before 2020 are not required to furnish a new form merely because of the. Do I need to ask all of my existing employees to fill out the new 2020 Form W-4. What It Means for You and Your Employees The Internal Revenue Service IRS has released the final version of the 2020 Form W-4.

Even the IRS is changing things up it just debuted a new Form W-4. Most workers arent required to file a new W-4 form with their employer in 2020 but you might want to anyway. This new form looks significantly different than the W-4 forms of the past due to the federal tax law changes that took place in 2018 which may lead to some questions from employees.

The new form is for use this year it is. The Treasury Department and the IRS issues a new Form every year since 1992. Because employees will better comprehend how to fill out the form tax.

The new form W-4 has been simplified to help employees reduce complexity and increase transparency. The new form is now titled Employees Withholding Certificate verses Employees Withholding Allowance Certificate The form is now broken out into 5 steps. Employees who have furnished Form W-4 in any year before 2020 are not required to furnish a new form merely because of the redesign.

On December 5 2019 the IRS released the 2020 version of the W-4 form. Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Well cover both here so you can understand if you should use them and why.

The IRS has released the final version of the 2020 Form W-4 with some important changes that could impact both employers and workers this tax season. The new form no longer uses withholding allowances. The new Form W-4 Employees Withholding Certificate is an updated version of the previous Form W-4 Employees Withholding Allowance Certificate.

The IRS launched this new form in 2020 removing withholding allowances. Do we need to have two payroll systems with the new Form W-4.

Irs Finalizes New W 4 To Help Taxpayers Correct Withholding Don T Mess With Taxes

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

Treasury And Irs Unveil New Form W 4 For 2020 Accounting Today

How To Fill Out The W 4 Form New For 2020 Smartasset

How To Fill Out The W 4 Form New For 2020 Smartasset

2021 New W 4 Form No Allowances Plus Computational Bridge

2021 New W 4 Form No Allowances Plus Computational Bridge

Irs W 4 2020 Released What It Means For Employers Tryhris

Irs W 4 2020 Released What It Means For Employers Tryhris

The 2020 W 4 Introducing The New Form And Seeing What Has Changed

The 2020 W 4 Introducing The New Form And Seeing What Has Changed

Take It Away Helping Clients With Withholding Accounting Today

Take It Away Helping Clients With Withholding Accounting Today

Challenges Of The New Form W 4 For 2020

Challenges Of The New Form W 4 For 2020

Everything You Need To Know About The New W 4 Tax Form Abc News

Everything You Need To Know About The New W 4 Tax Form Abc News

45 Of Taxpayers Don T Remember When They Last Updated Their Withholding Cpa Practice Advisor

45 Of Taxpayers Don T Remember When They Last Updated Their Withholding Cpa Practice Advisor

Irs Has Lauched A New W 4 For 2020 Insightfulaccountant Com

Irs Has Lauched A New W 4 For 2020 Insightfulaccountant Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.