Commissioned sales people are the same. Your income is 33000 unless there is depreciation to add back in.

The main benefit of a loan is that you stop making payments after your term is over.

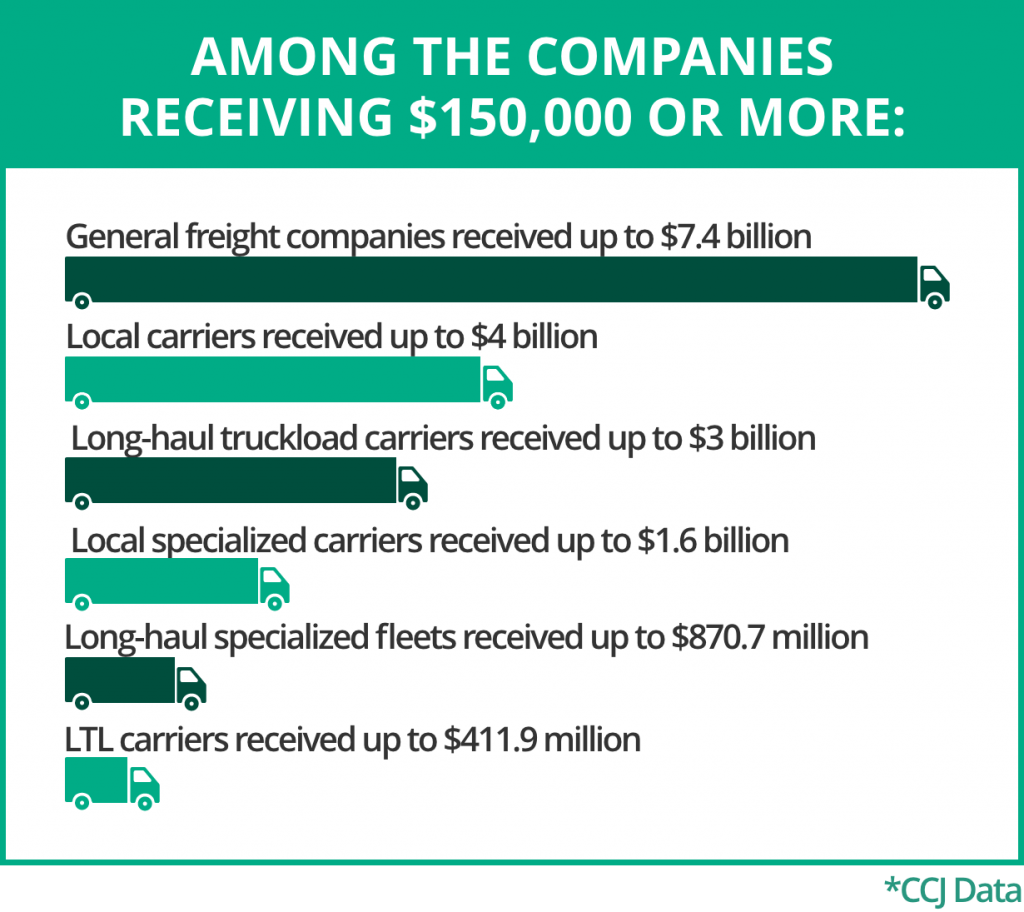

Loans for truck drivers. Meanwhile small trucking companies most likely to be slammed in a recession can receive loans from the Small Business Administration but the process is. You are saying it cost you. Funding amounts vary with each individuals situation and you will need to get in contact with your local employment agency to find out more httpwwwtcugovoncaengemploymentontario.

In March ATBS released an eBook outlining the ways the CARES Act could assist owner-operators. You may also apply for a term loan of up to 250000 to purchase your truck other equipment or for other large purchases for your trucking company. No matter your situation we can help you explore different avenues to fund.

Loans can be obtained by individuals with bad credit often with a co-signer but be wary because some of these loans have outlandish interest rates. There is also no prepayment penalty on any contract or loan offered. You now own a 5-year-old truck.

From truck repairs to accidents and driver overtime an SBA 7a loan can provide the money your firm needs to keep on trucking. At Kabbage Funding we want to help you cut through the red tape to get the trucking loan you need. An employee truck driver was recently denied a zero-down VA home loan.

We work with several reputable employers including the Missouri DOT. I have never done a mortgage for an OTR truck driver that I didnt need 2 years of tax returns. The benefits of commercial truck loans are.

Lets say youve got a 5-year lease and your drivers average 50000 miles per year. The main drawback is that you might now own a truck that you no longer want. The majority of these grants werent designed for the transportation industry but may be used for the initial costs of purchasing gear and your truck.

Even if you are approved it can take days to get your small business loan and your opportunity could be gone by then. As with the Contract Training when you sign know what you are agreeing to. You made 53000 but wrote off 20000.

What type of loans are available for truck drivers. The trucking business can be extremely competitive and in some situations it could be in your best interest to purchase the competition. Extra capital also goes a long way for peace of mind in the event of an unforeseen accident.

Many truck driving schools offer loans through financial companies they work with. There are no hidden fees. Common financing types include the following.

We have a good relationship with our local job centers who can authorization grant funding for eligible individuals through WIOA. Our application process is similar to applying for a truck driver loan from a lender. A commercial truck loan makes you a commercial truck owner.

The payments are collected by automated debits until the advance plus a small service fee is repaid in full. Do home loan lenders understand how trucker per diem works that is the question. Visit this page to learn about the business and what locals in Atlanta have to say.

Provide basic data and well review your business performance to give you the funding you need up to 250000. Because he claimed per diem on his taxes at the end of the year and his income was too low for the VA loan. The ebook has been downloaded by over 10000 truckers.

But if he did not claim per diem for two years they could use his wage statements as pure income. Must have tax returns. A Giggle advance for truck drivers allows you to access additional working capital by selling a percentage of your future sales.

What is legal in IRS eyes does not help you when buying a home. We offer a 200 hour 5-week Class A truck driving program and a 60 hour 2-week Class B CDL truck driving program. Business Grants for Truck Drivers.

Giggle approves and funds for your advance application in minutes. This results in paying less in finance charges over the life of the loan. Company Grants or Loans.

You answered your question. There are many different Government Small Business Grants which can help you begin and prepare your truck company. Contracts provided by Mission are typically simple interest loans that allow you to make payments early or in excess of your monthly payment amount to pay down your principal balance faster.

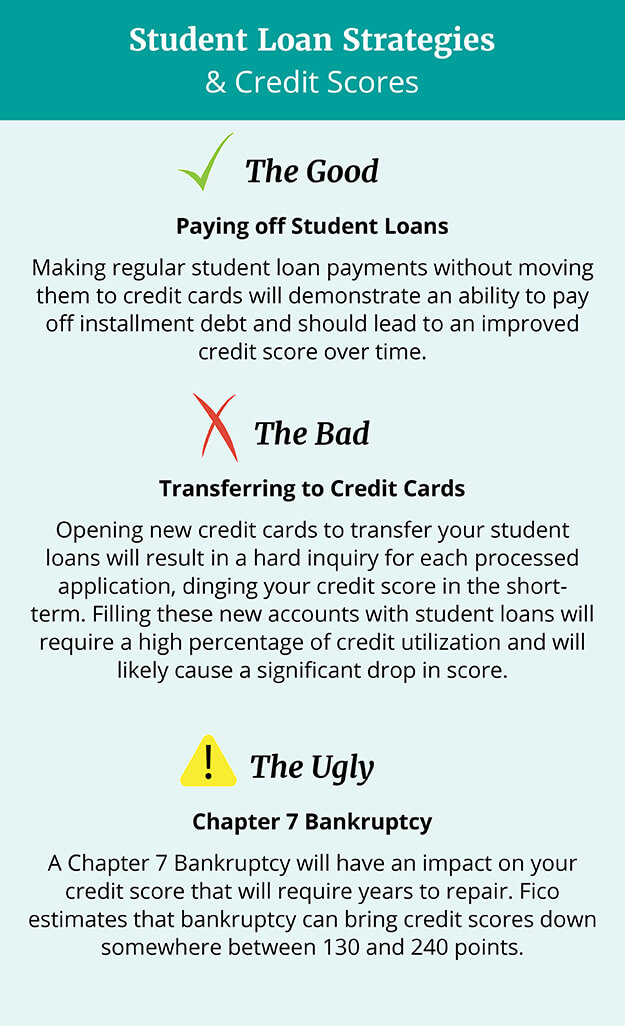

Each funding option has advantages and disadvantages. A commercial truck loan can help you preserve your working capital by providing cash flow to use towards maintaining your vehicles purchasing truckers equipment fueling up and other essential trucking expenses. In total ATBS has assisted over 900 owner-operators with loan requests totaling nearly 10 million.

You may be eligible for funding through Second Career Program offered through the Ministry of Training Colleges and Universities tcugovonca. When youre done paying off your loan the lender will hand over the title and the truck is officially yours. Our loans for truckers are available through a fast simple application thats fully automated.

Military veterans also have their own options to consider. Also you might have the ability to acquire tender bids of the size that is adequate to get the. Commercial Truck Loan.

Ways to get financial aid assistance for truck driving school include the Workforce Investment Act student loans scholarships tuition reimbursement and company-paid training. Equipment financing short-term loans a business line of credit invoice factoring and SBA loans. Do local business owners recommend Loans for Truck Drivers.

Acquiring their routesclients trucks and some if not all of their drivers. Repayment terms of up to 18 months are available for OnDecks term loans.