By Jazmin Goodwin CNN Business. The provision was introduced in March 2021 as the Student Loan Tax Relief Act and was led by Democratic Sens.

Student Loan Debt Statistics 2021 Average Total Debt

Student Loan Debt Statistics 2021 Average Total Debt

Even before the change borrowers still need to learn as.

Student loan 2021. Check Your Options for Parent PLUS Loan Forgiveness April 30th 2021. All federal student loans are currently 0 interest and require no payments through September 30 2021. Every student accrues debt hoping that better education will lead to a better future.

Universal student loan forgiveness. Maintenance Loans and Grants in Scotland 202122 The funding body in Scotland Student Awards Agency for Scotland or SAAS offers grants as well as loans. However most of them struggle to meet the loan obligations after graduation.

Borrowers were not obligated to make payments on federal student loans through the end of 2020. But after last years relief legislation addressing student loans many borrowers may see some changes to their net deduction. A millennial couple paid off 123000 in student loans in a year by making 4 straightforward lifestyle changes Liz Knueven 2021-05-04T144546Z.

Updated 503 PM ET Mon February 15 2021. Through the Relief Act borrowers will. How Do Student Loans Work in 2021.

73000 in aggregate for. That covers roughly 85 of all federal student loans including those known as direct federal loans and PLUS loans that parents have taken out. Loan amounts available.

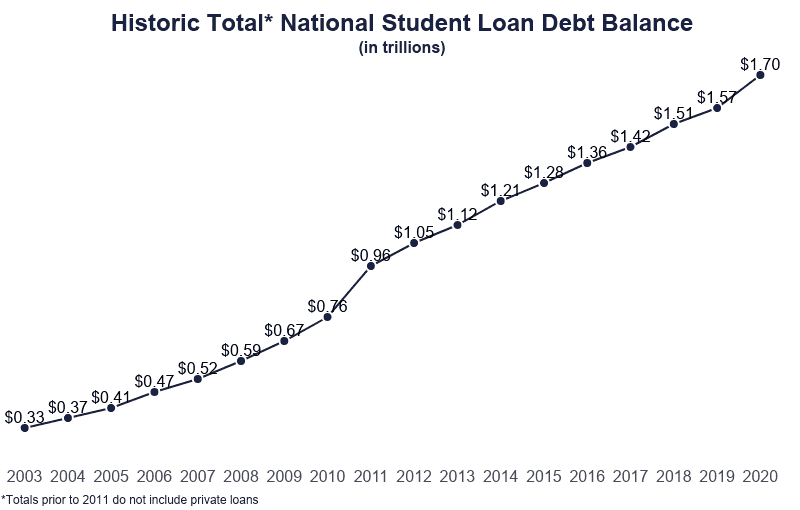

Americans also now owe more than 153 trillion in student loan debt with the average student loan debt amount of 37172 and monthly payment of 393 based on the most current figures available to Nitro. Here are some answers. With student loan forgiveness on the table you may be wondering if youll qualify for it or if you should still be making payments.

This leaves only three months out of the year that payments continued as usual and. Elizabeth Warren and Bob Menendez. This new proposal in Congress could help you pay off student loans and save for retirement.

Since March 27 2020 federal student loan interest rates have been set to 0 and payments have been paused. 2 Federal student loan interest rates are currently at record lows. Heres what you need to knowand what it means for your student loans.

Read This Before You Get Graduate PLUS Loan April 24th 2021. Heres how to make the most of it. As of 2021 1 in 4 Americans have student loan debt which is an est.

2021 federal budget waives student loan interest another year invests in student aid The government will also create an additional 215000 job skill development and work opportunities by increasing funding to federal job placement programs such as Canada Summer Jobs. If you believe your student loan servicer may change in late 2021 or early 2022 its important to stay alert regarding upcoming changes. Beginning July 1 2020.

January 23rd 2021. Student loan payments are suspended. But the policy is set to expire on Oct.

Targeted student loan forgiveness. 34500 in aggregate for independent undergraduate students. Prop up existing student loan forgiveness programs.

However unlike in the rest of the UK the loans offered to students from Scotland dont differ based on your living situation. Settle Your Student Loan Debt. Elizabeth Warren D-MA proposed applies only to federal student loans.

Here are three potential options considered in 2021. Student loans. Student debt has become a major problem in the US concerning more than 40 million people.

Read This Before You Choose Revised Pay As You Earn Repayment REPAYE April 25th 2021. The leading proposal for student loan forgiveness in Congress which Senate Majority Leader Chuck Schumer D-NY and Sen. 8000 in aggregate for dependent undergraduate students.

Last March the CARES Act put a pause on student loan payments and froze interest growth. Maxine Waters on Student Loans- 2021 Guide May 3rd 2021.

.png?width=801&name=Student%20Debt%20Statistics_Asset_15A%20(2).png)