If a worker finds a lower-cost plan on the exchange you may be taxed. If you have more than 50 employees youll have to provide affordable health insurance that provides minimum value.

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

If you are a single person making more than 400 of that amount 51040 you will likely not qualify for subsidies.

Obama care cost for low income. So if the plan is 5000 your subsidy is 35244. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. Instead of an income cap the new rules allow for premium subsidies if the cost of the benchmark plan would otherwise exceed 85 of their ACA-specific modified adjusted gross income.

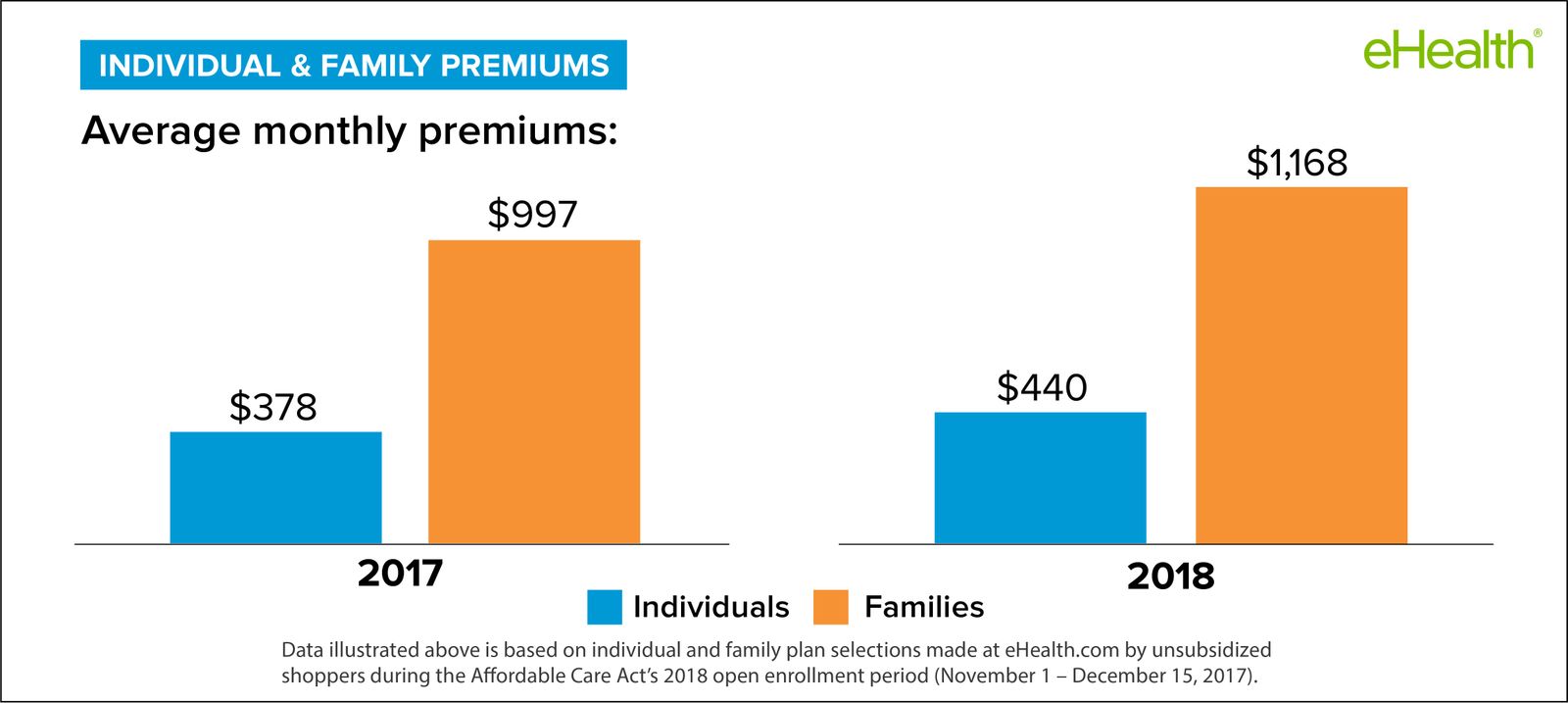

According to the Federal Register the 2020 poverty level for an individual is 12760. Your subsidy is the cost of the plan minus 464746. The average family may pay 9996 over a single year for monthly health insurance premiums under Obamacare and an additional 7983 in deductibles for a combined total of 17979.

Monthly premiums range from a low of 219 in New Hampshire and Massachusetts to 760 in Alaska. Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. A single eviction costs the community an estimated 10000 according to the researchers calculation.

Estimating your expected household income for 2021. This schism is turning Obamacare into another government benefit program for lower- and moderate-income Americans. 695 for an adult and 34750 for a child up to a max of 2085 per family annually or 25 of family income above a certain tax filing threshold KFF estimated the tax filing threshold was.

On the lower end subsidies are available in most states if your income is at least 139 of the poverty level with Medicaid available below that. For example a 27-year-old making 50000 would pay 7 of their income in premiums for the average lowest-cost plan nationally whereas a 60-year-old making the same income would pay 17 of. You can probably start with your households adjusted gross income and update it for expected changes.

The national average of the lowest cost plan under ObamaCare before cost assistance in 2020 is 331 for Bronze 442 for Silver and 501 for Gold. These lower the cost of health care services for people residing in households with an income situated at 100 to 400 below the US federal poverty level. With that noted the costs of health plans vary by a limited set of factors including plan region age family size and what type of assistance you qualify for based on income.

That level of income also was low enough that all of the clients qualified for the added Obamacare aid of cost-sharing reductions which are available to people with taxable incomes. In 2015 that penalty is the higher of 325 per individual or 2 percent of taxable household income. Obamacare Facts Toggle navigation Get Covered.

The typical enrollee has an income of only 165. In that case they say the money saved preventing evictions would offset 32 percent of the. Second the ACA is intended to further expand the Medicaid program which then helps cover medical expenses for adults with an income 138 below the US federal poverty level.

The national average monthly cost of the lowest cost plan under ObamaCare before cost assistance in 2021 is 328 for Bronze 436 for Silver and 482 for Gold. Otherwise for all but the first 30 employees you pay a tax of 2000 per employee. The ACA also offers people who earn between 100.

The discount on your monthly health insurance payment is also known as a premium tax credit. Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to.

In Oklahoma its increasing 69 to 424. As a rule of thumb if you project to make between 12490-49960 as an individual and 25750-103000 as a family of four in 2020 youll qualify for cost assistance on 2020 plans please note specific thresholds adjust upwards every year. The average individual in 2016 may pay 3852 in a year for monthly premiums and an additional 4358 for his or her deductible for a combined total of 8210.

The federal poverty level varies based on the number of members in your household.