Character-based decision making was popular when granting credit. Think of your credit score as being similar to a grade point average GPA only instead of telling you how youre doing in your school classes it indicates how well youre managing your credit.

![]() How Long Do Hard Pulls Stay On Your Credit Report Mybanktracker

How Long Do Hard Pulls Stay On Your Credit Report Mybanktracker

With a school report card that GPA doesnt.

When is your credit score created. The three big credit-reporting bureaus Equifax Experian and TransUnion have access to slightly different information about you and use that information to score you in slightly different ways. Like a GPA your credit score is a representation of your efforts at a specific point in time. You must request a credit score separately.

Best described as the presence or lack of derogatory information. Your starting score will only be calculated once youve had credit such as a credit card or a loan in your name for at least six months. They are calculated using the information from your credit report but they are not part of the credit report.

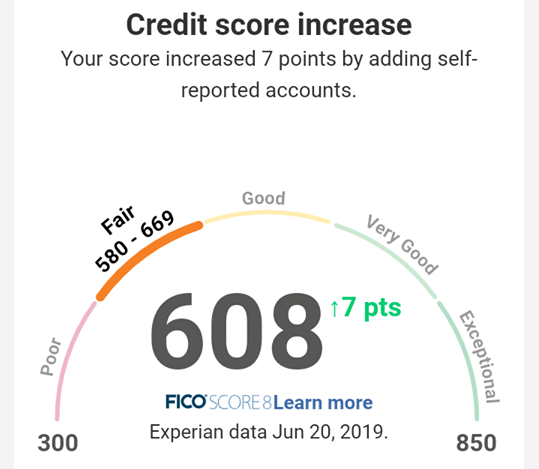

That is the basis of your credit score so reviewing it at least once a year and correcting any errors on it is crucial. The higher the score the more creditworthy you are. An excellent score can land you lower interest rates meaning you will pay less for any line of credit.

Everyone begins without a credit score and it will require six months of history in order to create a persons first credit score. There are a number of ways to request your credit scores. Although theres not enough space here to review every step leading to the FICO Score in particular there are some facts to its final development that are of great interest.

These numbered scores are essentially the result of mathematical equations that attempt to assess your credit worthiness in a simple clear manner. For example you could have an excellent credit score but if the lender didnt like. How Credit Scores Are Actually Created Step 1.

Although the exact formulas for calculating credit scores are secret FICO has disclosed the following components. In the case of your GPA that point in time is when your report card is issued. Credit scores are designed to measure the risk of default by taking into account various factors in a persons financial history.

When credit scores came into existence and where they first appeared is a long story - one that actually starts in the mid-1800s. Your credit report is created when you borrow money or apply for credit for the first time. Lenders send information about your accounts to the credit bureaus also known as credit reporting agencies.

So if youre going through this process with a spouse friend or family member try not to compare them as equals because there are. Once the child turns 18 Experian will share their credit history and the authorized user account could help the childs credit. What Does Your Credit Score Start At.

First a credit bureau will agree to provide the credit score developers with sets of credit. The concept of credit scores started in 1989 and would evolve into todays most popular scoring model the FICO Score from Fair Isaac and Company. Your credit score is a three-digit number that comes from the information in your credit report.

One of the most important things that you need to keep in mind is that everyones credit history is different. Next begins process of observing the various trends and correlations. Experian Equifax and TransUnion.

Along with the number you should also receive an explanation of what the score means in terms of risk and a list. In fact you may not have a credit score at all. Bankruptcy liens judgments settlements charge offs repossessions.

Before the FICO Score credit was determined based on the character of the consumer. What Affects Your First Credit Score. It shows how well you manage credit and how risky it would be for a lender to lend you money.

In addition credit scores are calculated based on the information in your credit report and there are three separate credit reporting agencies. Your credit score is one number that can cost or save you a lot of money in your lifetime. Identify the predictive characteristics.

Using your credit reports which is essentially a listing of your credit activity the Fair Isaac Corporation or FICO creates your credit scores. A parent legal guardian or the minor themselves once theyre 14 can request a minors credit report. Your credit score doesnt necessarily have a specific starting point.

When you get your credit report you will not see a credit score with it. There are a couple different ways that people say that your credit score is created but this is directly from the company itself that started the FICO scores. There is no magical age at which a credit score is given to you a credit score is created only when there is data to analyze.

So lets start as close to the beginning as possible.