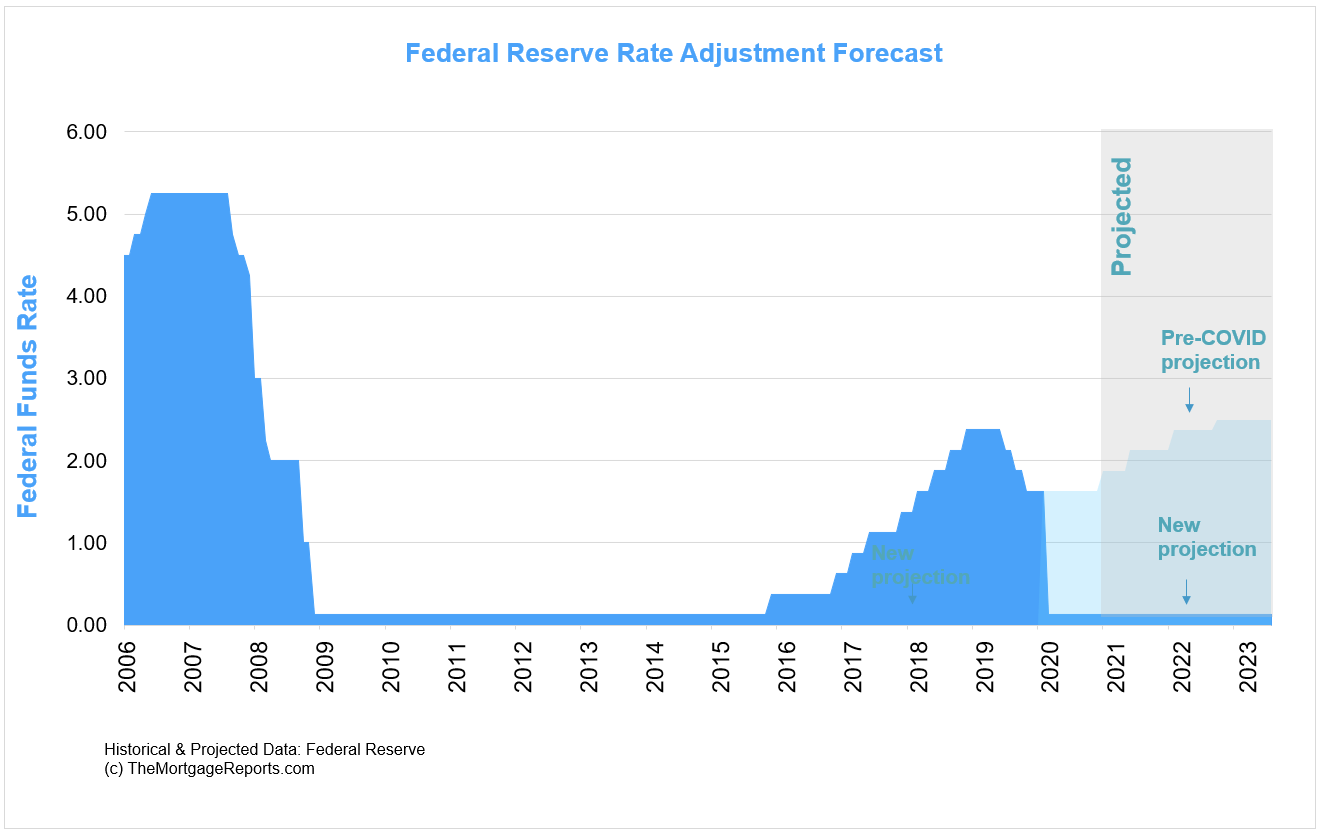

Prime Rate Forecast As of right now our odds are at 100 certain the Federal Open Market Committee will vote to leave the target range for the benchmark fed funds rate at the current 000 - 025 at the April 28 TH 2021 monetary policy meeting and keep the United States Prime Rate aka Fed Prime Rate at 325. Tue Mar 30th 2021.

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

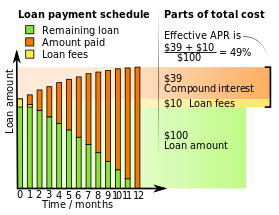

39 up from 06 last week.

What is the fed interest rate today. Compare fixed and adjustable rates today and lock in your rate. The FOMC has voted to leave the. Therefore the United States Prime Rate remains at 325.

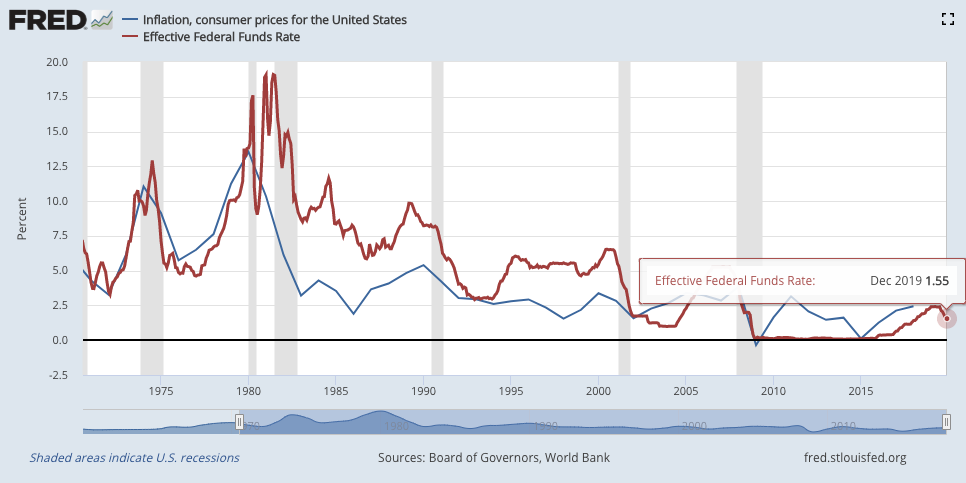

The federal reserve ordered two emergency decreases to. It is often used as a reference rate also called the base rate for many types of loans including loans to small businesses and credit card loans. Fed holds interest rates near zero sees faster growth and higher inflation.

What is the prime rate and does the Federal Reserve set the prime rate. The prime rate is an interest rate determined by individual banks. The prime rate today is 325 according to.

As such they are set to see a drop in interest rates since the prime rate does closely follow the Feds benchmark federal funds rate. Fed Prime Rate is. The Fed said Sunday that it was cutting its benchmark federal funds rate by 1 to a range of 0 to 025 alongside other measures meant to stimulate the nations economy as it takes a.

39 down from 86 last week. Sep 2021 - up by at least 25 bps. At this time the FED has adopted an interest rate range of 000 to 025.

Your borrowing and spending One interest rate that has risen by as many percentage points as the federal funds rate in the past few years is the. The current American interest rate FED base rate is -0482 Note. Dec 2021 - up by at least 25 bps.

Federal Reserve System FED. Critics slam the Fed as home prices rise at a historic rate. The current federal reserve interest rate or federal funds rate is 0 to 025 as of March 16 2020.

Learn what to expect next. Apr 2021 - up by at least 25 bps. Target range for the fed funds rate at 0 - 025.

Fed funds futures probabilities of future rate changes by. 15 rader What is the current prime rate. For today April 30th 2021 the current average mortgage rate on the 30-year fixed-rate mortgage is 2925 the average rate for the 15-year fixed-rate mortgage is 2219 and the average rate.

These are adjustable-rate loans based on the prime rate. The next FOMC meeting and decision on short-term. Fed Funds Rate Current target rate 000-025 025 What it means.

The Fed has maintained its target interest rate at 0 to 025 since March 15 2020 in response to the COVID-19 pandemic. 39 down from 45 last week. The Fed left the target range for its federal funds rate unchanged at 0-025 during its March meeting and signalled a strong likelihood that there may be no rate.

On September 18 2019 the Federal Reserve also called the Fedcut the target range for its benchmark interest rate by 025. The interest rate at which banks and other depository institutions lend money to each other usually on an overnight basis. Prior to March 1 2016 the EFFR was a volume-weighted mean of rates on brokered trades.

See rates from our weekly national survey of CDs mortgages home. As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report of Selected Money Market Rates FR 2420. View current mortgage interest rates and recent rate trends.