How soon can you refinance your home after purchase. Your refinance timeline depends on the type of mortgage you have.

How Often Can You Refinance Your Home Embrace Home Loans

How Often Can You Refinance Your Home Embrace Home Loans

Typically youll need to wait six to 12 months between getting a mortgage and seeking to refinance.

How soon can you refinance. 5 Zeilen How soon can you refinance. If you opt for the streamlined assist refinance your payments must have been. Your current loan already accounts for the costs of your last refinance.

Have an FHA loan for which you. While some may believe you shouldnt refinance again until reaching the break-even point on your last loan this is not technically true. Since you have to requalify for your new loan you must apply for refinancing exactly as you did for your initial.

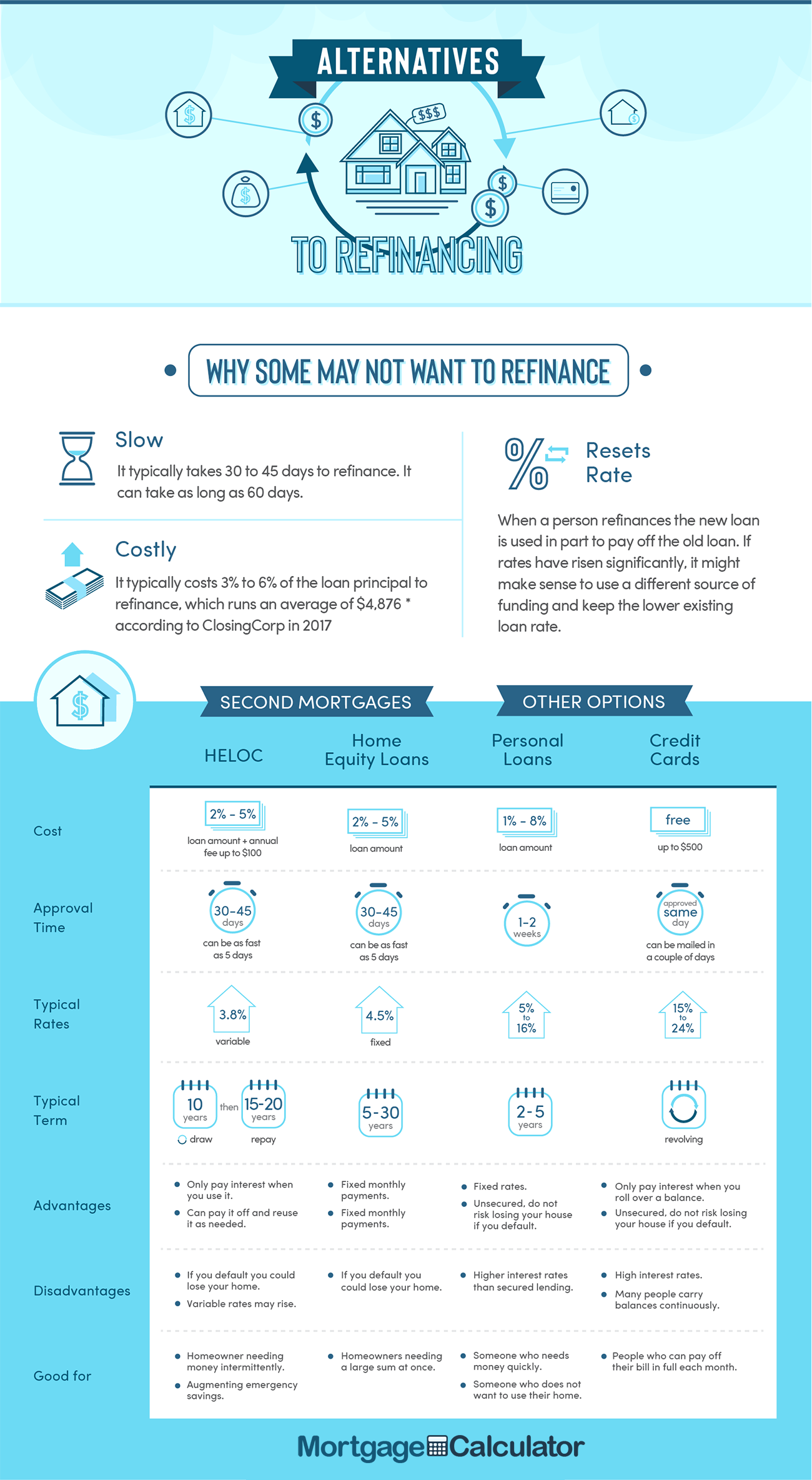

Refinancing is possible immediately after buyingeven before you make your first monthly payment. There is no limit to how many times youre allowed to refinance a mortgage though a lender may enforce a waiting period between when you close on a loan and refinance to a new one. Analyze both your last refinance and your current refinance situation to determine if refinancing is worth the hassle.

But be careful if you arent lowering your payments or reducing the term of the loan. When you refinance a mortgage you take out a new loan to pay for the initial one. You can refinance your mortgage soon after you close.

If you financed the remaining 30162 at 339 percent for the remaining. Wait at least 60-90 days from getting your original loan to refinance. It depends on the type of refinance And the type of loan you have and desire Rate and term refis may not require a waiting period Cash out refis generally require a wait of six months or longer.

1 Refinance Soon After Closing to Secure Lower Interest Rate. Want to take extra cash out tap your equity to pay for something big like a remodel automobile or debt consolidation. For either the streamlined refinance or non-streamlined refinance your payments must have been made in a timely fashion during the past 180 days.

The timing of that same modification regarding your mortgage loan will serve users to schedule their finances soon to find the right borrower throughout ones circumstance. When it comes to how soon you can refinance your mortgage though it. It typically takes this long for the title on your vehicle to transfer properly a process that will need to be completed before any lender will consider your application.

Conventional loan No seasoning requirement for rate-and-term. Just be sure that you actually end up with a better deal and that refinancing doesnt cause you to pay more for your. If you have a conventional loan backed by.

You do not need to wait any minimum amount of time before refinancing your car loan. If youre refinancing to eliminate private mortgage insurance you may have to wait two years. If your goal is to refinance into another USDA loan youll have three options.

While some homeowners can refinance shortly. For example suppose you were just five months into a 72-month 32000 new car loan at 66. If after nine years you refinance into a new mortgage with a principal amount of 270000 at a fixed rate of 3952 for 30 years assuming 6000 in closing costs refinancing would save you.

Refinancing this early typically only works out for those with great credit. Refinancing sooner versus later can also be a good strategy if you. Need to take a partner off your loan due to a recent separation.

This usually takes 45 days to refinance a property and it can also differ based on the economic condition and investor scrutiny. There are some good reasons. One thing to keep in mind according to Michael Saccucci the director of statistics and data science at Consumer Reports is that the earlier you refinance the more you could save if you get a significant reduction in interest rates.

When Can You Refinance. However you must have a USDA guaranteed loan at least one year before youre eligible to refinance. How quickly youll be able to refinance your home loa n depends on the type of mortgage you have.

How soon can I refinance after exiting forbearance. You just have to meet all the requirements for the new loan to refinance. In fact the fourth quarter of 2020 broke a record from nearly two decades ago for refinance volume in a single quarter.