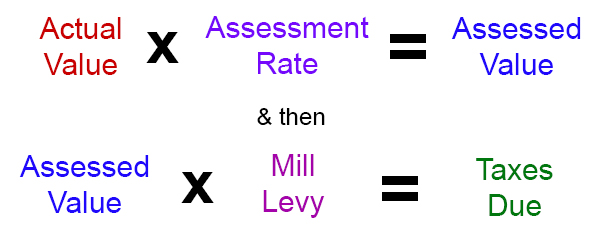

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Levy rates are determined by the total assessed value of all property located within the county.

Factors such as your propertys size construction type age.

Total assessed value property tax. Property tax rate. Taxable Value of Real Estate You may pay tax on the full assessed value of your house but many local governments only tax some of it. A property tax assessment estimates the fair market value of your property.

Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. For example if you paid 1430 in property taxes and the local property tax rate equals 22 percent divide 1430 by 0022 to find your propertys assessed value equals 65000. Property Assessments in Alberta.

So for example if your total tax rate is 15 and your home value is 100000 you will owe 1500 in annual property taxes. Divide your property tax bill by the property tax rate to calculate your propertys assessed value. Assessed Value Property Tax Bill x 100 Tax Rate Lets assume that you own a home and want to know its assessed value.

During the same decade 149 homes sold for exactly 1 million. Each year the county assessor conducts physical inspections of 20 of all properties due for inspection within the county and compares assessed values from the previous years to sale prices to determine the other 80. One of the first items listed on a property tax bill is the assessed value of the land and improvements.

The assessed value of land and improvements is important because the 1 percent rate and voterapproved debt rates are levied as a percentage of this value meaning that properties with higher assessed values. Tax Rate A rate is developed by dividing the total tax levy by the total assessed value in order to determine each property tax payers share of the levy. Their average presale assessed value.

Properties can be assessed by different methods depending on whether theyre residential or commercial. So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value of your home is 160000. The assessed value ratio for arriving at the assessed value varies considerably by state.

The percentage at which your property is taxed. California for example offers a 7000 homestead exemption. Wondering how the county assessor appraises your property.

The total amount that will be billed in property taxes. Again this will depend on your countys practices. Then you check your countys website to find that your tax rate is 1.

The assessment or indicated ratio is the total assessed value of property in the county divided by the total true and fair value. However if your taxing authority assesses homes at 70 percent of value your 150000 market value home will have a tax assessed value of 105000. If you have a home that has a market value of 150000 your home will be assessed at 150000.

In most states final property assessment values are a percentage of the propertys fair market value. Assessed value is the taxable value of the property which includes the land and any improvements made to the land such as buildings landscaping or other developments. In 2020 the provincial education tax rate was set at 0255 of total residentialfarmland equalized assessment value and 0375 of total equalized assessment value for non-residential properties.

Annual property taxes are determined by multiplying the assessed fair market value against the local property tax rate. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. Since the cost of services is 2000 the tax rate is 2000500000 0004 or 04.

Tax rates are calculated by local jurisdictions Determining tax rates. This is calculated by first adding up the value of all three properties for a total of 500000. Generally the property tax rate is expressed as a percentage per 1000 of assessed value.

Each property owner in the municipality pays a proportion of that 2000 based on their propertys assessed value. The taxing jurisdiction school district municipality county special district develops and adopts a budget. You receive the property tax bill and its to 1350.

Their average assessed value before the sale was 151585. In the table below we look at each countys effective tax rate which is equal to the amount of property tax that homeowners actually pay as a percentage of their homes value. Assessed Value An amount determined by the Assessors office and is used in the calculation of the tax bill of a property owner.

How is the property tax levy rate calculated.

.png)

/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.