For all other tax filing statuses the phaseout limit is 200000. The credit begins to phase out when adjusted gross income reaches 75000 for single filers 150000.

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Plus any UCCB and RDSP amounts repaid line 21300 and line 23200 of your or your spouses tax return You have 1 child in your care.

How to get maximum child tax credit. This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families. The new child tax credit raises the 2020 limits from up to 2000 per child to a maximum of 3600 -- but the math gets complicated fast. Your AFNI is below 31711.

Some families will get a larger maximum credit. 5 x 50 250. The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit.

You will need to include the name and social security number for each qualifying kid on your. To be eligible for the child tax credit married couples filing jointly must make less than 400000 per year. The Child Tax Credit amount that may be refunded is equal to 15 of earned income see my post on the earned income tax credit which can be claimed separately as well above 2500.

300 per month for children under six The full credit is available to individuals who have children and adjusted gross income of less than 75000 or 150000 for a married couple filing jointly. This can include dependents over the age of 16 and dependents who dont have the required SSN. You cant carry forward any portion of the Child Tax Credit to future tax years.

X Maximum Child Tax Credit. Thats up from a maximum of 2000 per child under 17. You get the maximum payment for your child and it is not reduced.

You can claim the child tax credit on your federal income tax return Form 1040 1040-SR or 1040-NR. Todays question comes from a lovely reddit user who asked how she could get the maximum value from the Child Tax Credit and Earned Income Tax Credit. 2000 250 1750.

The Child Tax Credit is a refundable tax credit of up to 3600 per qualifying child under 18. The child tax credit calculator can help you figure out if you are within the income limits and how much you can get back. You could be eligible for the Child Tax Credit up to this amount based on your specific circumstances as reported on your tax return.

You need to claim the nonrefundable credits in a certain order to get the most benefit. For example your actual Child Tax Credit might be reduced due. For your eligible child.

Your Child Tax Credit Results. The amount you can get depends on how many children youve got and whether youre. You might need to calculate other credits first to properly apply the credit.

Its an interesting case study and a great opportunity to showcase how to create a tax plan and a tax budget. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. The enhanced portion of the credit is available for single parents with annual incomes.

Qualified children aged 5 and under count for 3600. Threshold for those entitled to Child Tax Credit only. To be eligible to claim the child tax credit your child or dependent must first pass all of the eligibility tests to qualify.

Single adults qualify for the full value of that larger credit if their annual income. 2021 child tax credit maximum payments Ages 5 and younger Up to 3600 with half as 300 monthly payments. That amount is capped and subject to income phaseouts more on.

The maximum refundable portion of the credit is limited to 1400 per qualifying child. Making a new claim for Child Tax Credit. For every 1000 the MAGI exceeds the limitations above the amount of tax credit allowed to be claimed is reduced by 50.

Already claiming Child Tax Credit. 3000 per kid ages 6 to 17 and 3600 for younger children. How to Maximize the Child Tax Credit and EITC.

This is maximum amount of child tax credit that this individual can claim.

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

Earned Income Tax Credit And Child Tax Credit 101 Center For American Progress

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png) Can You Claim A Child And Dependent Care Tax Credit

Can You Claim A Child And Dependent Care Tax Credit

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Schedule 8812 H R Block

Maximizing The Child Tax Credit Even Without Earned Income Go Curry Cracker

Maximizing The Child Tax Credit Even Without Earned Income Go Curry Cracker

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

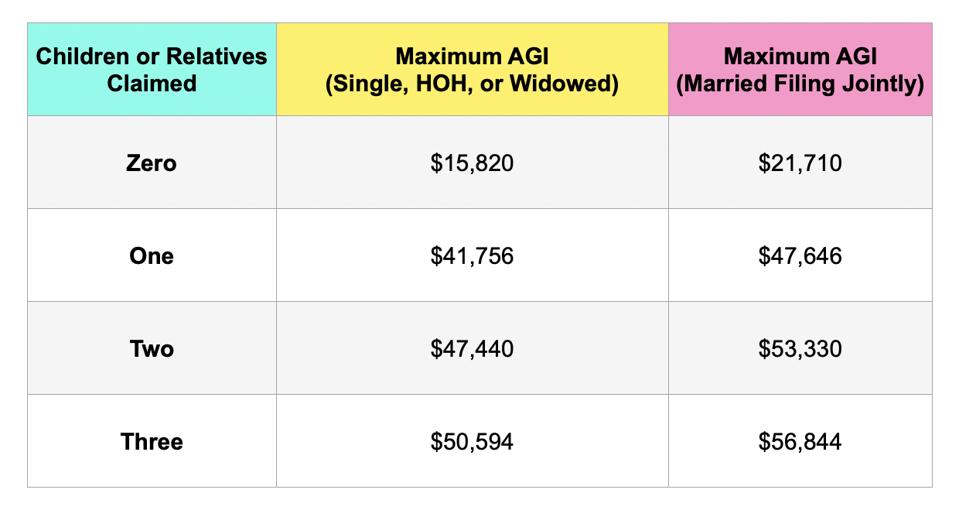

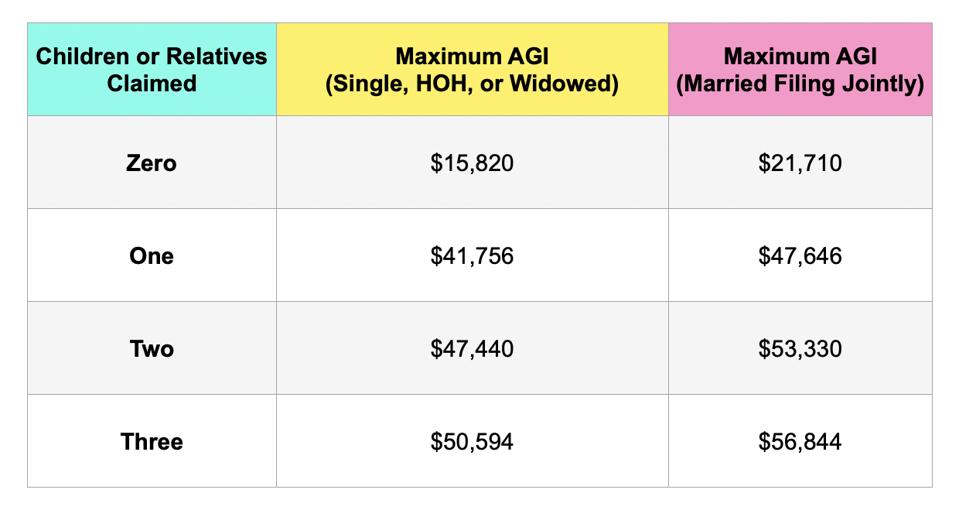

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Here S What You Need To Know About The Earned Income Tax Credit In 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.