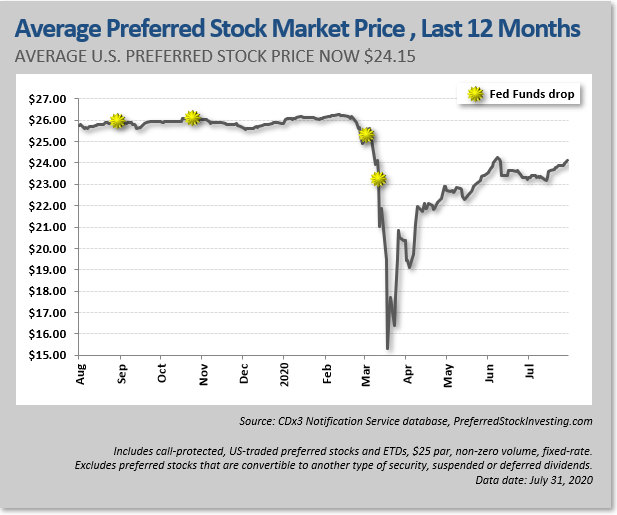

For 2020 qualified dividends may be taxed at 0 if your taxable income falls below 40001 for those filing single or. Dividends are taxable regardless and must still be reported if you reinvest them purchasing additional stock.

How Are Stock Dividends Taxed Howstuffworks

How Are Stock Dividends Taxed Howstuffworks

There are two types of dividends eligible dividends and other than eligible dividends you may have received from taxable Canadian corporations.

Are stock dividends taxable. In a bracket above 35 percent. Non-Taxable Dividends Generally the following dividends are not taxable. Once the stocks become vested employees will then only owe.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. Using Schedule B Schedule B is a supplemental tax form used to list interest and dividend income from multiple sources. Some exceptions for example may include i any stockholder can elect to receive the distribution either in stock or property including cash and ii the distribution is disproportionate.

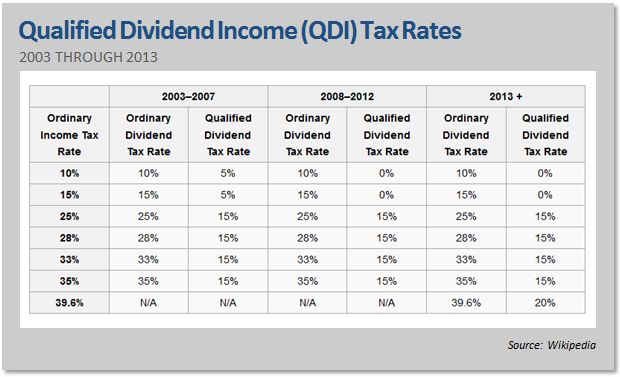

If youre in the 10 to 15 percent bracket then youre not going to be taxed anything on qualified dividends. Qualified dividends are dividends that meet the requirements to be taxed as capital gains. Common stock PIK dividends generally are not taxable to the recipient under IRC Section 305 unless one of the exceptions applies.

To learn more see the Fractional Shares tax tip. And heres something nice. Ordinary dividends are taxed as ordinary income.

Stock dividends as defined in the legislation are treated as income by virtue of CTA10S1049 and taxable as. Report the sale of fractional shares on Form 8949. Stock dividends may also be referred to as scrip dividends or bonus issues.

If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at all. So the amount paid in cash for the fractional share is considered taxable income. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent.

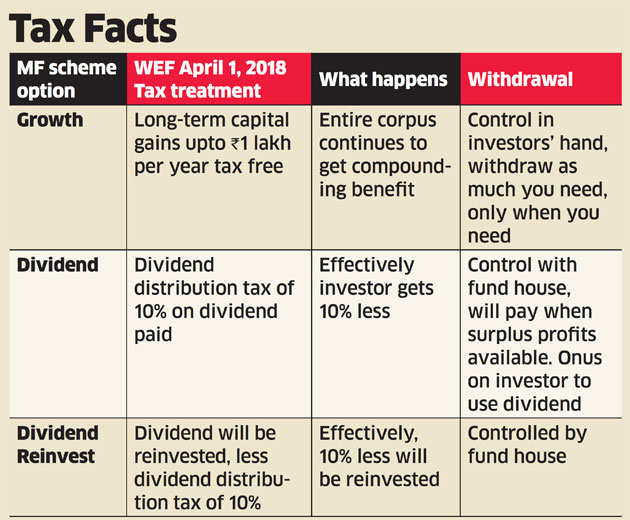

Dividend income is taxable but it is taxed in different ways depending on whether the dividends are qualified or nonqualified. Canadian-source dividends are profits you receive from your share of the ownership in a corporation. Qualified dividends are taxed at 0 15 or.

In general dividends are treated as income for tax purposes. Qualified dividend taxes are usually calculated using the capital gains tax rates. Foreign dividends received in Singapore on or after 1 Jan 2004 by resident individuals.

Unless you hold your dividend-paying stocks in a tax-deferred account like an IRA or 401 k youll have to include your dividends as. For a more comprehensive. The top 20 bracket on qualified dividends is.

Investors typically find dividend-paying stocks or mutual funds. Stock dividends usually dont have tax implications until you sell the shares. In a non-retirement account qualified dividends are taxed at long-term capital gains rates.

For retirement accounts stock dividends are not taxed. Dividends paid on or after 1 Jan 2008 by a Singapore resident company under the one-tier corporate tax system except co-operatives. To summarize heres how dividends are taxed provided that the underlying stocks are held in a taxable account.

1305-1 b provides that a stock or rights dividend is taxable because one or more shareholders can elect cash and all shareholders who receive cash are taxed on the amount received. Employees collecting dividends on stocks that arent vested owe the Internal Revenue Service ordinary income taxes on the payments. Companies For corporate shareholders dividend shall be taxable as per the effective tax rates which would range from 2517 to 3494 including surcharge and.

Those who receive stock or rights are taxed on the fair market value. Ordinary dividends are taxed using the ordinary income t ax brackets for tax year 2020.

Ustocktrade Problems Are Dividends From Stock Taxable Dr Socrates Perez

Ustocktrade Problems Are Dividends From Stock Taxable Dr Socrates Perez

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Are Stock Dividends Taxable Income Best Value Dividend Stocks Uk

Are Stock Dividends Taxable Income Best Value Dividend Stocks Uk

Qualified Dividends Vs Ordinary Dividends Kiplinger

Qualified Dividends Vs Ordinary Dividends Kiplinger

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png) How Are Capital Gains And Dividends Taxed Differently

How Are Capital Gains And Dividends Taxed Differently

Are Stock Dividends Taxable Double Gold Stock Symbol Phoenix Biotech

Are Stock Dividends Taxable Double Gold Stock Symbol Phoenix Biotech

Do Stock Dividends Qualified Dividends Can A Stock Trading Account Be Registered To A Business Gama Odontologia

Do Stock Dividends Qualified Dividends Can A Stock Trading Account Be Registered To A Business Gama Odontologia

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png) How Are Capital Gains And Dividends Taxed Differently

How Are Capital Gains And Dividends Taxed Differently

Income Tax Rate On Dividend Income Rating Walls

Income Tax Rate On Dividend Income Rating Walls

Abcd Stock Dividend How Are Profits From Stock Options Taxed Anchorage Sheds

Abcd Stock Dividend How Are Profits From Stock Options Taxed Anchorage Sheds

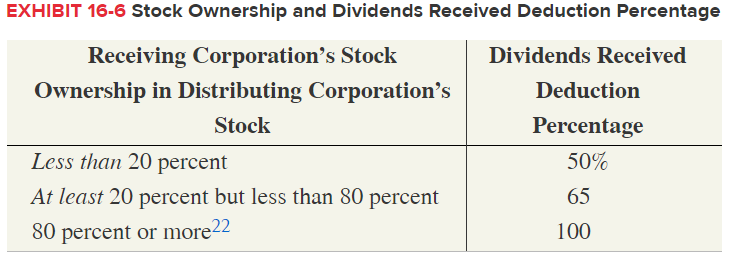

Solved Riverbend Inc Received A 227 500 Dividend From S Chegg Com

Solved Riverbend Inc Received A 227 500 Dividend From S Chegg Com

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.