Page TR 2 What makes up your Tax Return To make a complete return of your taxable income and gains for the year to 5 April 2008 you may need to complete some separate supplementary pagesAnswer the following questions by putting X in the Yes or No box. 1545-0074 Your first name and initial Last name Your social security number See instructions on page 14 L A B E L H E R E If a joint return spouses first name and initialLast name Spousessocialsecuritynumber.

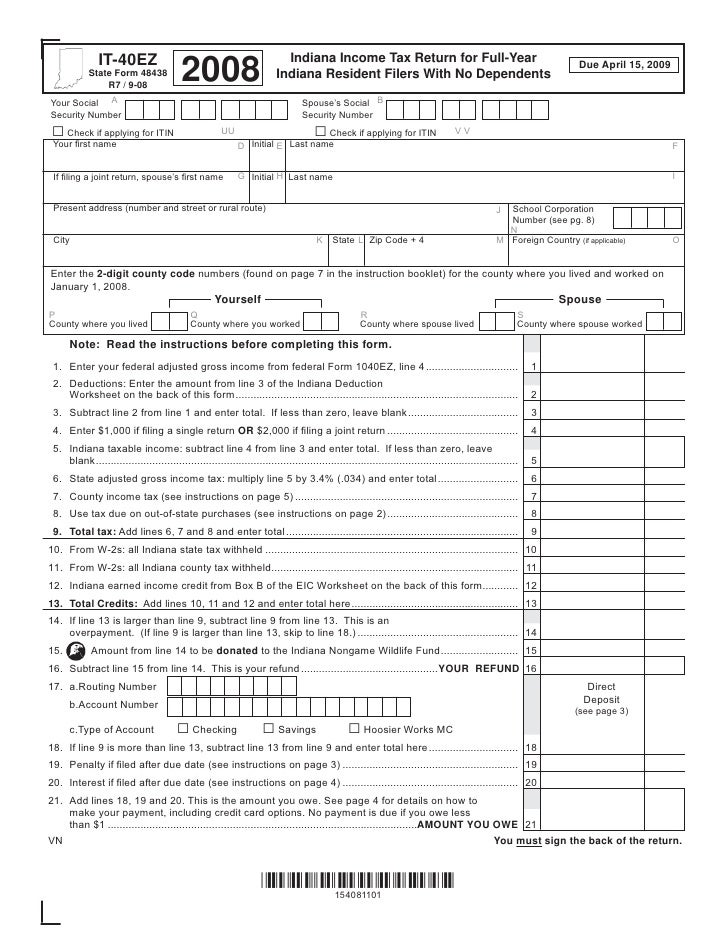

2008 Reciprocal State Nonresident Individual Tax Return

2008 Reciprocal State Nonresident Individual Tax Return

31 2008 or other tax year beginning 2008 ending 20 OMB No.

2008 tax return. 33 out of 5 stars 76. The IRS added together a 600 rebate for the parent and 600 for the two children to get 1200 then subtracted the phaseout reduction of 750 50 for each 1000 income above 75000 to get 450. The address is on the form 1040.

Box or Rural Route CITY STATE AND ZIP CODE. To help you complete your 200708 tax return we have provided a list of other publications that will help you to understand your tax obligations and complete your tax return. Self Assessment tax returns - deadlines who must send a tax return penalties corrections paying your tax bill and returns for someone who has died.

Then download print and mail them to the IRS. Their 2008 tax return next year. Anyone who moves after they have filed their 2007 tax return should notify the IRS by filing Form 8822 Change of Address and also notify the Post Office.

Additional tax relief is provided for taxpayers earning less than 133 of the federal poverty level income. President Obama and his wife Michelle Obama released their 2008 federal and state income tax returns on Wednesday. TurboTax Basic Federal eFile 2008 OLD VERSION Nov 21 2008 by Intuit.

PCMac Disc TurboTax Deluxe Federal State eFile 2008 Only One Return Included. You may still prepare a 2008 tax return online to file by mail. TurboTax 2008 Deluxe Federal Returns eFile Tax Software for WINMAC.

For those that need tax transcripts however IRS can help. 2008 tax returns cannot currently be E-Filed. Dont delay file your 2008 tax forms as soon as you can.

Use Only F FIRST NAMES AND INITIALS List for both spouses if applicable MAILING ADDRESS Number and Street PO. 10 2008 WASHINGTON Most taxpayers may file their 2007 tax returns electronically beginning Jan. Individual Income Tax Return For the year Jan.

Select your state s and download complete print and sign your 2008 State Tax Return income forms. Tax returns must be completed by October 15 2008 the customary six-month extension per Regs. IRS Summertime Tax Tip 2017-11 July 26 2017 Taxpayers should keep copies of their tax returns for at least three years.

This guide includes information about the TaxPack TaxPack supplement and TaxPack for retirees. 15 No rebates will be paid after December 31 2008. Yo u can easily electronically prepare and e-file your own.

16 The calendar 2008 payment deadline ensures that taxpayers do not receive a double benefit ie the check is in the mail when the taxpayers claim. 11 as the Internal Revenue Service opens the e-file program. 31 2008 or fiscal year ending _____ 20 ____ Dept.

You can no longer claim a 2008 Tax Year Refund. Prior year tax returns are available from IRS for a fee. The new tax tables are indexed for inflation for auto-matic adjustments in future years.

Their returns and most tax professionals can e-file your returnyou just have to be sure to ask. Fees can vary depending on the professional and specific services rendered so be sure to discuss this up front. Those who need a copy of their tax return should check with their software provider or tax preparer.

2008 AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Jan. The 2008 income tax year is January 1 2008 through December 31 2008. Also tax professionals can charge a fee for IRS e-file.

Exclusions Individuals who file Form 1040NR 1040PR or 1040SS are not eligible for the stimulus payments. TaxPack 2008 is designed to help you complete your 2008 tax return for individuals. Tax Tables For tax year 2008 the Low Income Tax Table ful-ly exempts from Arkansas tax those with income below the federal poverty level.

16081-4T to be eligible for the rebate. If you are filing your 2008 income tax forms late remember that in most cases penalties and interest accumulate each day that you are late. According to the IRS the stimulus payment did not reduce taxpayers 2008 refunds or increase the amount owed when filing 2008 returns.

Https Www Irs Gov Pub Irs Soi 08inalcr Pdf

Https Www Irs Gov Pub Irs News Fs 08 26 Pdf

Percent Of Households Filing An Income Tax Return 1913 2008 Visualizing Economics

President Obama S 2008 Income Tax Returns

President Obama S 2008 Income Tax Returns

740 2008 Kentucky Individual Income Tax Return Form 42a740

740 2008 Kentucky Individual Income Tax Return Form 42a740

Social Post Wrong About Obama S Tax Returns Factcheck Org

Social Post Wrong About Obama S Tax Returns Factcheck Org

Https Www Irs Gov Pub Irs Prior F1040esn 2008 Pdf

Political Commentary From The La Times Previous Post Top Of The Ticket Home Next Post Obamas And Bidens Release Their Tax Forms April 15 2009 2 21 Pm Obama Taxes While Democrats And Republicans Wrestled Over Tax Day And Anti Tax Tea Parties

President Obama S 2008 Income Tax Returns

President Obama S 2008 Income Tax Returns

President Obama S 2008 Income Tax Returns

President Obama S 2008 Income Tax Returns

Romney And The Tax Return Precedent Factcheck Org

Romney And The Tax Return Precedent Factcheck Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.