Please note that if you are a NYC resident you will have additional local taxes assessed on your income. State Taxes on Unemployment Benefits.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Use this rate to calculate line 4 on the Quarterly Combined Withholding.

Nys unemployment tax form. Visit Department of Labor for your unemployment Form 1099-G. To learn about New York States tax treatment of unemployment. Less than 0 The Unemployment Insurance contribution rate is the normal rate PLUS the subsidiary rate.

Choose the Create NYgov Account button at the left and follow the directions. Log in to your NYGov ID account. Please see Form TP-64 Notice to Taxpayers Requesting Information or Assistance from the Tax Department for updated information if you are using any documents not revised since December 2010.

If you received unemployment compensation in 2020 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. This applies even if the wages are not subject to contributions.

Get 1099-G Unemployment Compensation Form Log into your NYGov ID account click Unemploment Services and select ViewPrint 1099-G to view the form. You can file a claim without all of these documents. File Your Initial Claim for Benefits.

4 Other - please complete co Street or PO Box. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. If you received an income tax refund from us for tax year 2019 view and print New York States Form 1099-G on our website.

Form 1099-G is the federal tax form that tallies your unemployment compensation and any tax withheld from it from the previous year. Employer Registration number or Federal Employer Identification Number FEIN of your most recent employer FEIN is on your W-2 forms Your copies of forms SF8 and SF50 if you were a federal employee. If you do not have an NYgov ID.

If completed this is the address to which your NYS-45 and NYS-1 will be directed. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. Find the forms you need - Choose Current year forms or Past year forms and select By form number or By tax type.

They do this on the Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45 which must be filed online see below for information about electronic filing. For 2021 the new employer normal contribution rate is 34. Click Unemployment Benefits Click Payment and Tax Withholding Options Click Tax.

This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. In addition if you had more income on your return you would most likely be in a higher tax bracket. Unemployment compensation is usually taxed in Delaware.

If you completed an application for Unemployment Insurance on the phone with the Telephone Claims Center please wait at least one business day before creating your NYgov ID. Its otherwise known as the Statement for. You may need to report this information on your 2020 federal income tax return.

New Yorkers can find their form 1099. Unemployment Insurance Return Form NYS-45 and Return of Tax Withheld Form NYS-1 Address. Wage Reporting and Unemployment Insurance Report NYS 45.

File Your Initial Claim. NYS tax brackets range from 4 to 882. The first step to finding out if you owe state and federal taxes on unemployment benefits is to locate form 1099-G.

Please copy and paste. Unemployment Insurance is temporary income for eligible workers who lose their jobs through no fault of their own. Form IT-558 New York Adjustments due to Decoupling from the IRC and its instructions Form IT-201 Resident Income Tax Return and its instructions Form IT-203 Nonresident and Part-Year Resident Income Tax Return and its instructions Form CT-225 New York State Modifications and its instructions.

File your claim the first week that you lose your job. This form does not include unemployment compensation. Login to labornygovsignin with your NYgov ID.

If you withheld 350 for NYS out of 14000 in unemployment this comes to a withholding rate of. This link may not work in Internet Explorer. To start or stop the withholding of federal or state taxes from your weekly benefits.

State Income Tax Range. However unemployment benefits received in 2020 are exempt from tax. The Tax Department issues New York State Form 1099-G.

Get Form 1099-G for tax refunds. Your most recent separation form DD 214 for military service. Visit the Department of Labors website.

You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Https Dol Ny Gov System Files Documents 2020 12 How To Get 1099g Online Pdf

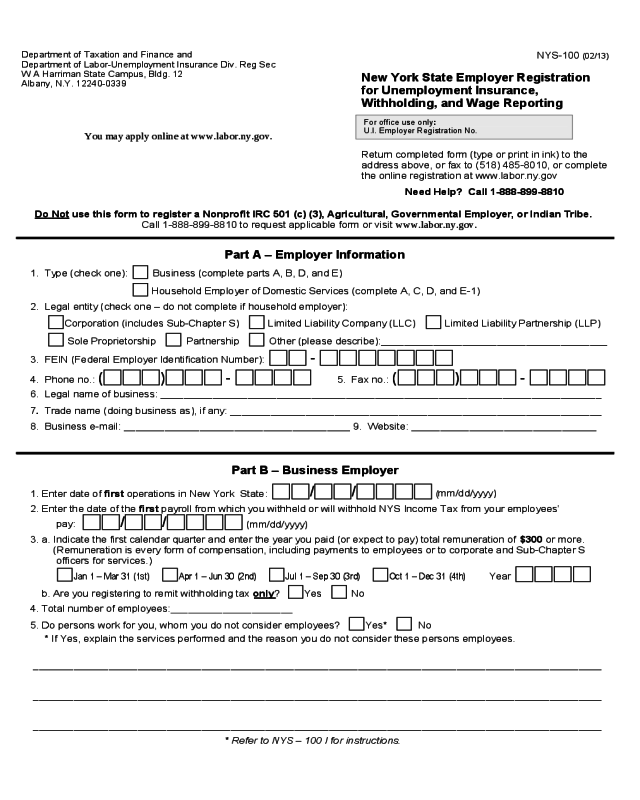

2013 2021 Form Ny Nys 100 Fill Online Printable Fillable Blank Pdffiller

2013 2021 Form Ny Nys 100 Fill Online Printable Fillable Blank Pdffiller

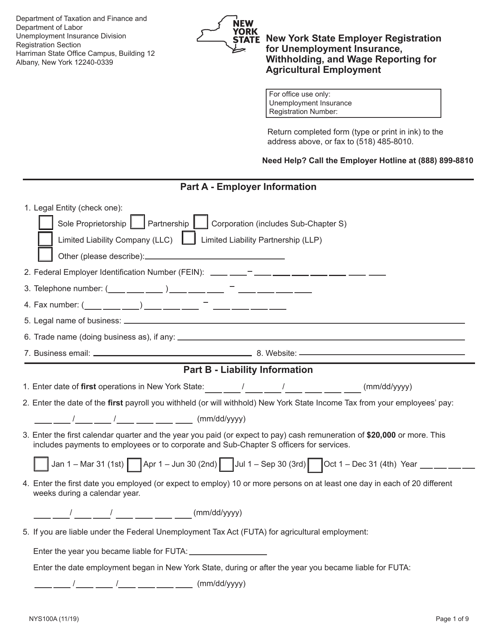

Form Nys 100a New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting For Agricultural Employment

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

Unemployment Insurance Form New York Edit Fill Sign Online Handypdf

Unemployment Insurance Form New York Edit Fill Sign Online Handypdf

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Https Dol Ny Gov New York State Employer Registration Form Unemployment Insurance And Withholding And Wage Reporting

Https Dol Ny Gov System Files Documents 2020 12 How To Get 1099g Online Pdf

Form Nys 100 New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting

Https Www Tax Ny Gov Pdf 2010 Inc It1099ui 2010 Fill In Pdf

Form Nys100a Download Fillable Pdf Or Fill Online New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting For Agricultural Employment New York Templateroller

Form Nys100a Download Fillable Pdf Or Fill Online New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting For Agricultural Employment New York Templateroller

Form Nys 100 New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting

Unemployment Insurance Form New York Free Download

Unemployment Insurance Form New York Free Download

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.