IRS Form 7004 requests an automatic extension of time to file numerous business tax returns. This form is used by partnerships multiple-member LLCs filing as partnerships corporations and S corporations.

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Proc 2019-32 granting an automatic six-month extension to eligible partnerships looking to file a superseding Form 1065 US.

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

Irs automatic extension. But if you need more time you will need to file for an extension with Form 4868. The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area.

Keep it with your records. However if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing payment or deposit due date falling within the postponement. The extension of the federal income tax filing and payment deadline to May 17 is completely automatic.

Therefore taxpayers do not need to contact the agency to get this relief. The extension is limited to the state individual and composite. The IRS announced an automatic extension of the April 15 due date to May 17 for certain taxpayers.

Your federal taxes are still due on May 17 so if you dont pay them by then you will incur penalties and interest. Because the extension is limited to the 2020 taxes first quarter estimates for tax year 2021 remain due on April 15 2021. The federal tax filing deadline for 2020 taxes has been automatically extended to May 17 2021.

The IRS grants an automatic five-month extension to some businesses such as partnerships and trusts and a six-month extension for many more including corporations and S corporations. The automatic deadline to file 2020 Tax Returns is May 17 2021 and you do not have. Under this option there is no need to file a separate Form 4868.

To get the extension you must estimate your tax liability on this form and should also pay any amount due. The IRS released Revenue Procedure Rev. On March 17 2021 the IRS announced an automatic extension of the April 15 due date to May 17 for certain taxpayers.

This extension is for six months and applies only to filing. To conform to the automatic extensions granted through IRS Notice 2021-59 the Department will extend individual and composite State income tax returns and payments of 2020 taxes due on April 15 2021 to May 17 2021. This extension also applies to 2020 tax payments.

Some tentative calculations are necessary to arrive at an estimated amount of tax due. Here are details on each of these special tax-relief provisions. Please note you must register for EFTPS before using.

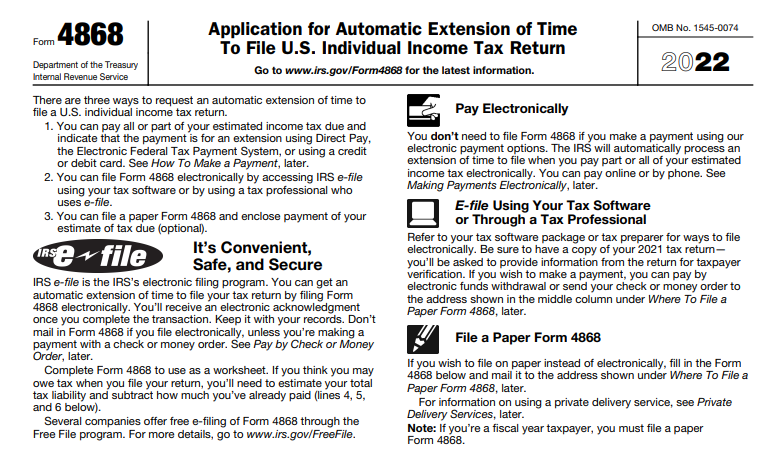

Is the IRSs electronic filing program. This gets you until Oct. Here are some dos and donts when it.

Individual income tax return. If you are a US. This relief is limited to individual taxpayers and only covers some tax return filings and payments that are due on April 15.

Return of Partnership Income and furnish corresponding revised Schedules K-1 Partners Share of Income Deductions Credits etc to each partner. Dont mail in Form 4868 if you file electronically unless youre making a. Automatic Tax Extension for US.

Youll receive an electronic acknowledgment once you complete the transaction. IR-2021-59 March 17 2021 The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. Resident living outside of the country on Tax Day and your main place of business is outside of the US you automatically receive a 2-month extension of time to file your return and time to pay any income taxes you may owe. 15 to file a return.

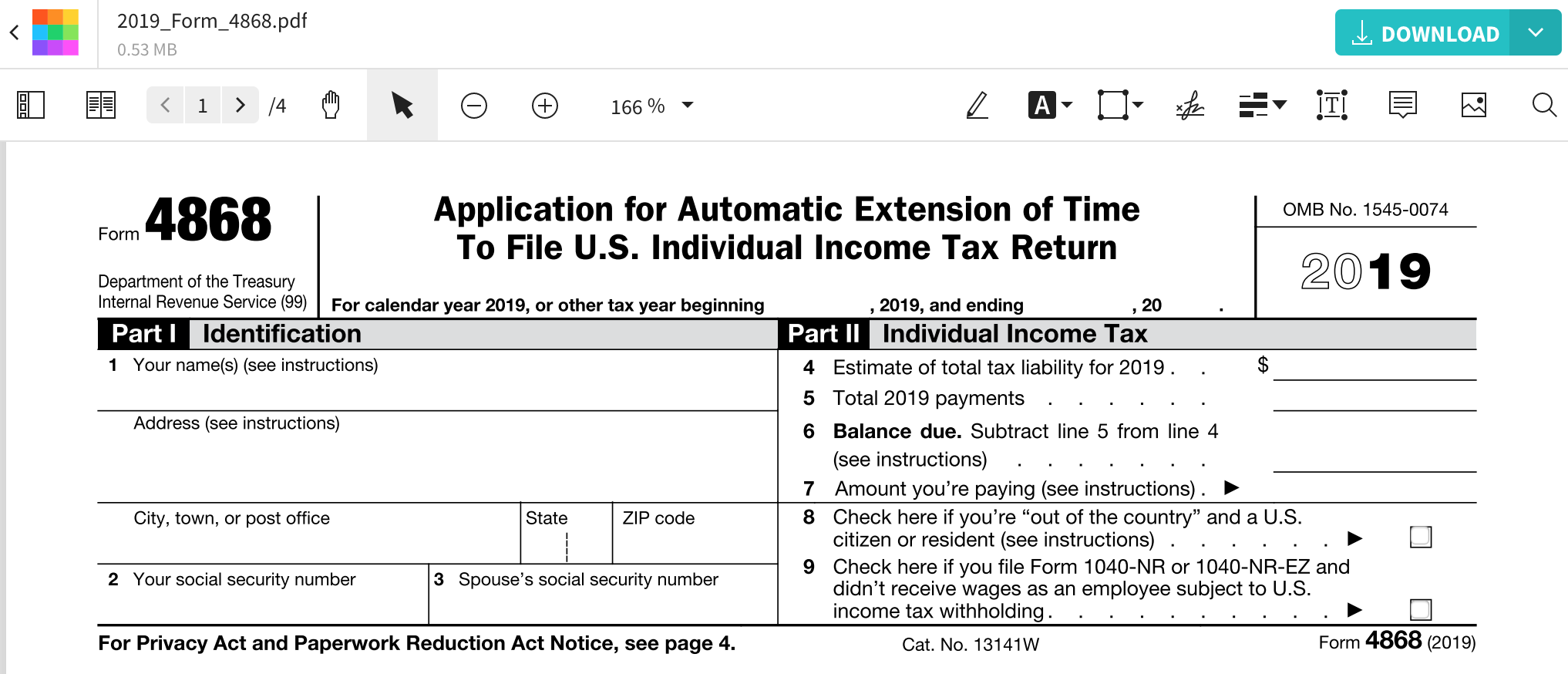

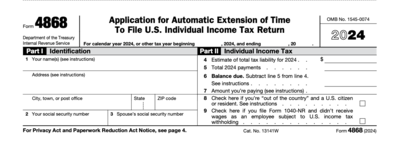

Form 4868 is used by individuals to apply for six 6 more months to file Form 1040 1040NR or 1040NR-EZ. Electronic payment options are available at IRS. The IRS will automatically process an extension when a taxpayer selects Form 4868 and makes a full or partial federal tax payment by the May 17 due date using Direct Pay the Electronic Federal Tax Payment System EFTPS or a debit or credit card.

The IRS estimates that more than 16 million taxpayers will get an automatic extension this filing season either by filing a form or making an electronic tax payment. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Form 7004 doesnt extend the deadline for payment of any taxes due but only for filing a return.

15 2021 to file your tax return. Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement Find out if you qualify for an offer in compromise -- a way to settle your tax debt for less. Due to severe winter storms the IRS has also extended the tax deadline for residents of Texas Oklahoma and Louisiana to June 15 2021.

Citizens and Residents Living Abroad. But some taxpayers including disaster victims those serving in a combat zone and Americans living abroad get more time even if they dont ask for it. If you need more time you can get an automatic income tax extension by filing IRS Form 4868.

Filing this form gives you until Oct. You can file an IRS Form 7004 electronically for most returns. Citizen or resident files this form to request an automatic extension of time to file a US.

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Calameo Irs Form 7004 Automatic Extension For Business Tax Returns

Calameo Irs Form 7004 Automatic Extension For Business Tax Returns

/486990777-56a938bc3df78cf772a4e5f7.jpg) How To File A Tax Extension For A Federal Return

How To File A Tax Extension For A Federal Return

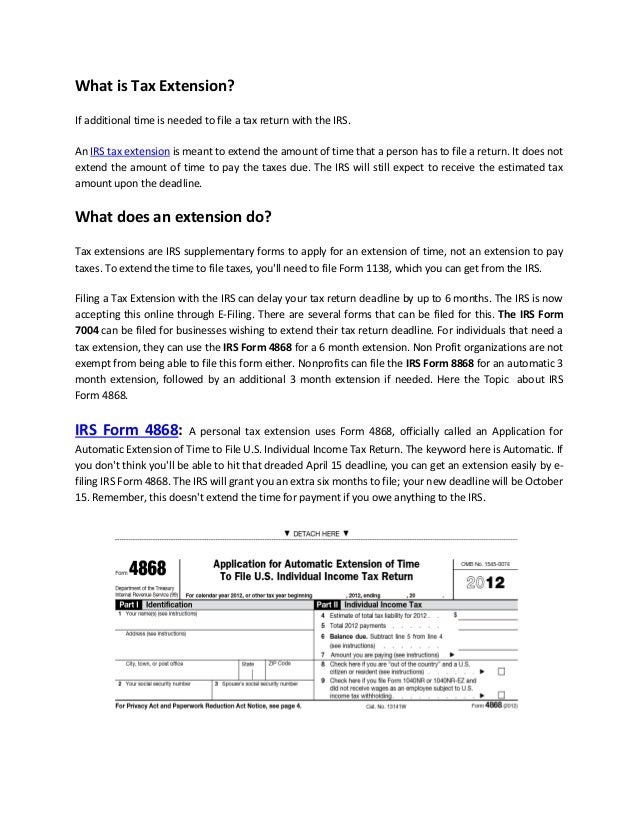

Https Www Irs Gov Pub Irs Pdf F4868 Pdf

Printable 2014 Irs Form 4868 Automatic Extension Of Time To File U S Income Tax Return Cpa Practice Advisor

Printable 2014 Irs Form 4868 Automatic Extension Of Time To File U S Income Tax Return Cpa Practice Advisor

E File Irs Form 4868 File 1040 Extension Online

E File Irs Form 4868 File 1040 Extension Online

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

File An Extension For Your Federal Tax Return Raleigh Cpa

File An Extension For Your Federal Tax Return Raleigh Cpa

:max_bytes(150000):strip_icc()/Screenshot64-177a60f2f4d6482eb80dfbc1be971169.png)

/ScreenShot2021-02-11at4.25.46PM-efc1304fa898450db5381a052fb0fcfe.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.