Some are and some are not. Normally municipal bonds are notably safe.

Dividend Stocks Vs Bonds In Retirement Intelligent Income By Simply Safe Dividends

Dividend Stocks Vs Bonds In Retirement Intelligent Income By Simply Safe Dividends

If you buy one in the state in which you live though theres a good chance that the interest from it wont be subject to state and local taxes either these are known respectively as double-exempt and triple-exempt bonds.

Are municipal bonds safe to invest in right now. Types of Bonds to Invest In Think. Bond funds are generally less risky than stock mutual funds. Municipal bonds are tax-free at the federal level.

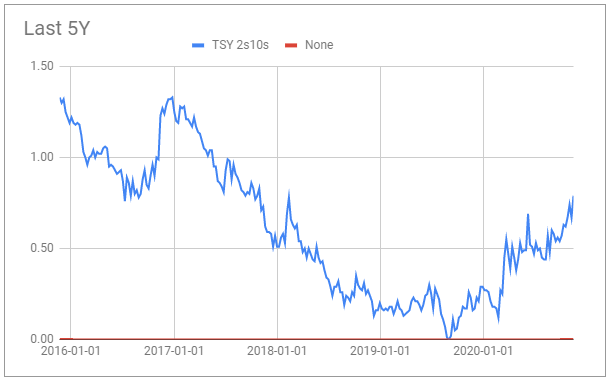

It means that now is a bad time to invest in municipal bond funds but it is not necessarily a bad time to invest directly in muni bonds. And if you buy a municipal bond issued by the state you live in you wont need to pay state tax on it either. If you buy bonds in a fund of.

General obligation bonds are backed by the taxing power of the governments that issue them while revenue bonds are tied to. The best idea for investors is to find suitable bond funds hold them for the long term and try not to pay much attention to fluctuations. Due diligence is required.

As each year passes by it seems like these rumors are increasing. To understand the difference it is important to remember how a bond works. It is likely that there will be many more downgrades than upgrades in the coming months so unless you are very skilled.

Municipal bonds historically have been one of the safest places to park your savings short of a savings account or Treasury bonds while also providing tax exempt returns and a generally much better return on invested capital than either FDIC insured accounts or Treasuries. Past performance is no guarantee of future results. Earnings on all muni bonds are exempt from federal income taxes but youll pay local taxes on muni earnings from bonds outside your state.

Despite headline fears you may have read about muni. Municipal bonds are relatively safe tax-exempt securities--but they are not without drawbacks. People believe there will be another market crash coming soon.

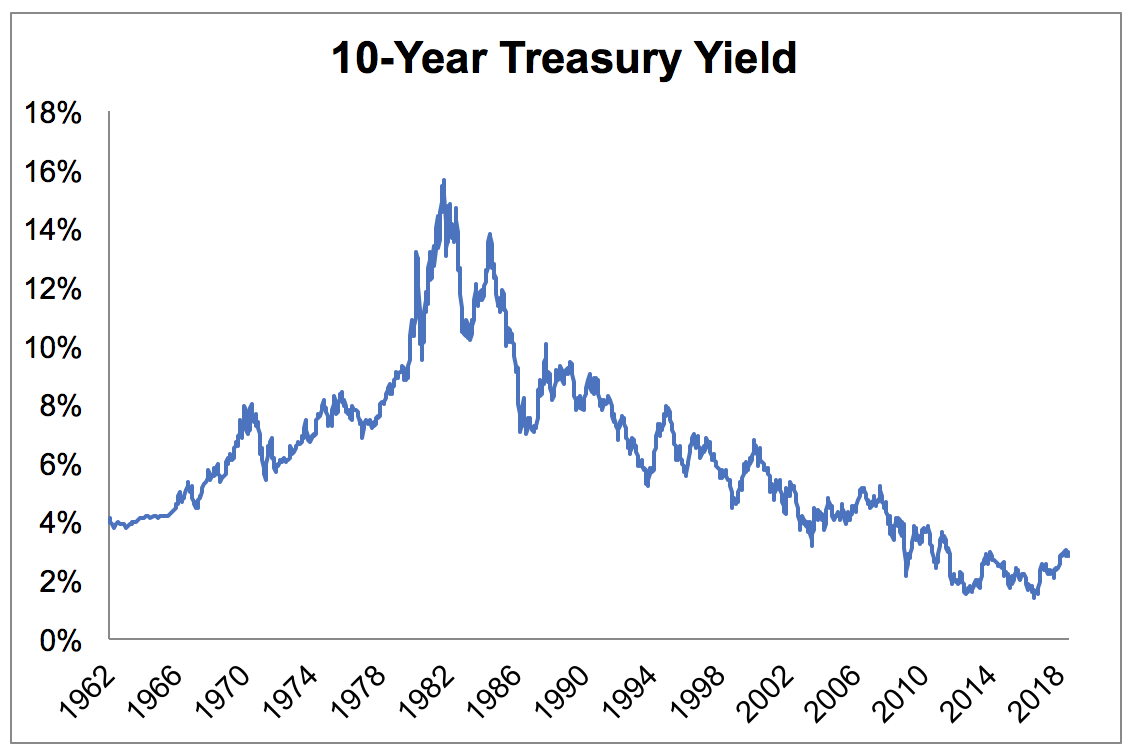

In a low-rate world however municipal bonds still offer an attractive combination of decent yields tax-free income and generally strong credit quality. Frankly the hype around this topic right now is real. But investors are wise to understand that the value of a bond fund can fluctuate.

Nowadays it is a common belief that bonds are safe heavens. Hiutin says muni bonds are historically very secure noting since 1970 the 10-year cumulative default rate for investment-grade municipal bonds is 01. According to De Santis the right bonds.

Treasury bonds are generally regarded to be the safest type of bond investment but generally dont provide the same rate of return as municipal bonds and dont have the same tax. For simplicity sake lets assume that an investor purchases a municipal bond from a state government agency for 1000. Compared to individual bonds buying municipal bonds as part of a mutual fund or ETF provides relative safety because it lowers the impact of a default says Mike Piershale ChFC president of Piershale Financial Group.

Corporate bonds and taxable municipal bonds assume a 5 state income tax for all brackets and a 38 ACA tax for the 32 and above tax brackets. Along with these rumors raises the question. Investing in the right bonds is equally important as investing in bonds said Massi De Santis a certified financial planner with DESMO Wealth Advisors.

Tax-free income remains a key benefit when it comes to investing in municipal bonds. Are bonds safe if the market crashes. Hold diversified portfolios of safe bonds and most importantly right now Rarely blink when the market tanks.

In addition to potentially higher yields the taxable muni market is higher in credit quality on average relative to the corporate market. Municipal or muni bonds collect income from the funding of projects like toll roads in Denver and a convention center renovation in Chicago.

Should You Invest In Bonds The Financial Gym

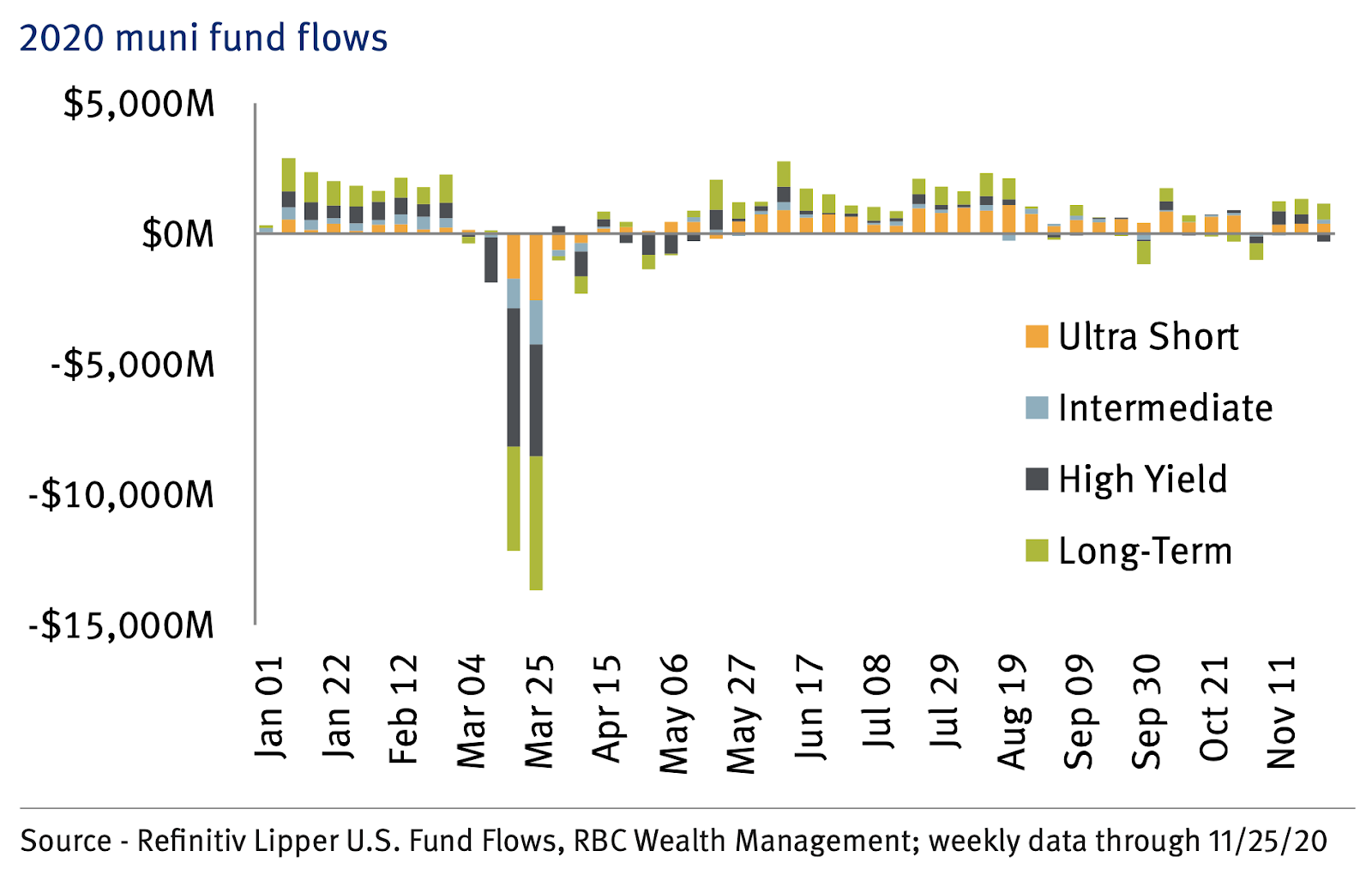

Muni Bond Market Slowly Reviving From Covid 19 Setback Putnam Investments

Muni Bond Market Slowly Reviving From Covid 19 Setback Putnam Investments

How Muni Bonds Fared In 2020 And What To Expect In 2021 Dividend Com

How Muni Bonds Fared In 2020 And What To Expect In 2021 Dividend Com

Muni Bonds No Longer The Safe Bet Inc Com

Muni Bonds No Longer The Safe Bet Inc Com

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

What S Going On In The Municipal Bond Market And What Is The Fed Doing About It

What S Going On In The Municipal Bond Market And What Is The Fed Doing About It

Investing In Municipal Bonds How To Balance Risk And Reward For Success In Today S Bond Market Fischer Philip 9780071809757 Amazon Com Books

Investing In Municipal Bonds How To Balance Risk And Reward For Success In Today S Bond Market Fischer Philip 9780071809757 Amazon Com Books

Hy Munis Worth A Look Vs Hy Corporate Credit Right Now Seeking Alpha

Hy Munis Worth A Look Vs Hy Corporate Credit Right Now Seeking Alpha

What Are Municipal Bonds Pros Cons Of Investing

What Are Municipal Bonds Pros Cons Of Investing

Are Municipal Bonds A Good Investment Right Now Where To Find Bargains Barron S

Are Municipal Bonds A Good Investment Right Now Where To Find Bargains Barron S

The 7 Best And Worst Bonds To Buy Right Now

The 7 Best And Worst Bonds To Buy Right Now

The Hidden Danger That May Be Lurking In Your Investment Portfolio The Motley Fool

The Hidden Danger That May Be Lurking In Your Investment Portfolio The Motley Fool

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.