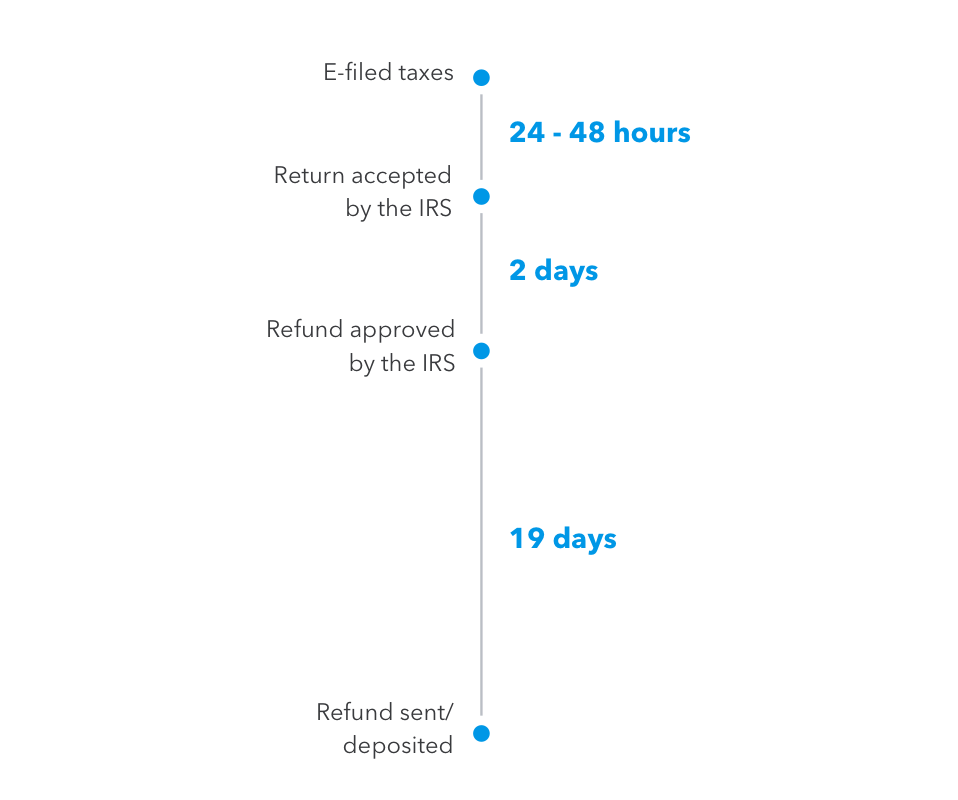

This means if it took the IRS the full 21 days to issue your check and your bank five days to post it you may be waiting a total of 26 days to get your money. Click here for a more complete list of important tax dates.

Deadline to file an extended return is October 15 2021.

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif)

When do tax returns go out. If you think you have overpaid tax through PAYE in the current tax year tell HMRC before the end of the tax year - April 5 2021 - and tell them why. The information in this article is current through tax year 2020. The tax year is from 1 April to 31 March.

Tax is usually deducted automatically from wages pensions and savings. Automatically issued income tax assessments and individual income tax returns - IR3s. The IRS officially opened the 2020 income tax season on Monday January 27 when it started accepting tax returns.

The first day to officially file your tax return is February 12 2021. Those who have already filed their taxes do not need to file an amended return. The IRS said that unemployment tax refunds will start going out to.

The chart below will help you determine the date when you should get your tax refund. Article continues below advertisement. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline.

People and businesses with other income must report it in a tax return. The annual deadline to file ones Federal individual income tax return is April 15. S o when can you expect to get your tax refund.

Theres usually a second. If its been longer find out why your refund may be delayed or may not be the amount you expected. Deadline to file and pay your tax bill if you have one is May 17 2021.

The IRS says it will automatically refund. The 2020 tax refund season is underway - the IRS started accepting 2019 income tax returns on Monday January 27 2020. The IRS lists scenarios for which Tax Day does not follow this standard deadline - Taxpayers can file an extension where the taxes owed must be paid by April 15 but the completed tax.

Almost 90 of tax refunds are processed and issued within 21 days. The tax refunds are expected to go out in May. The IRS usually issues 9 out of 10 refunds within 10 days after efiling.

April 15 is the due date for all 2020 tax returns but filing your taxes sooner will not only potentially speed up delivery of any tax refund you might collect but also position you to get any. The aim is that you pay the right amount of tax at the right time so that you dont overpay during the year or have a bill to pay at the end of the tax year. In general the IRS notes that it issues most refunds within 21 days of receiving your tax.

If you submit your tax return by. While not exact our chart below can help you predict when you will get. Well it depends on when and how you file your taxes.

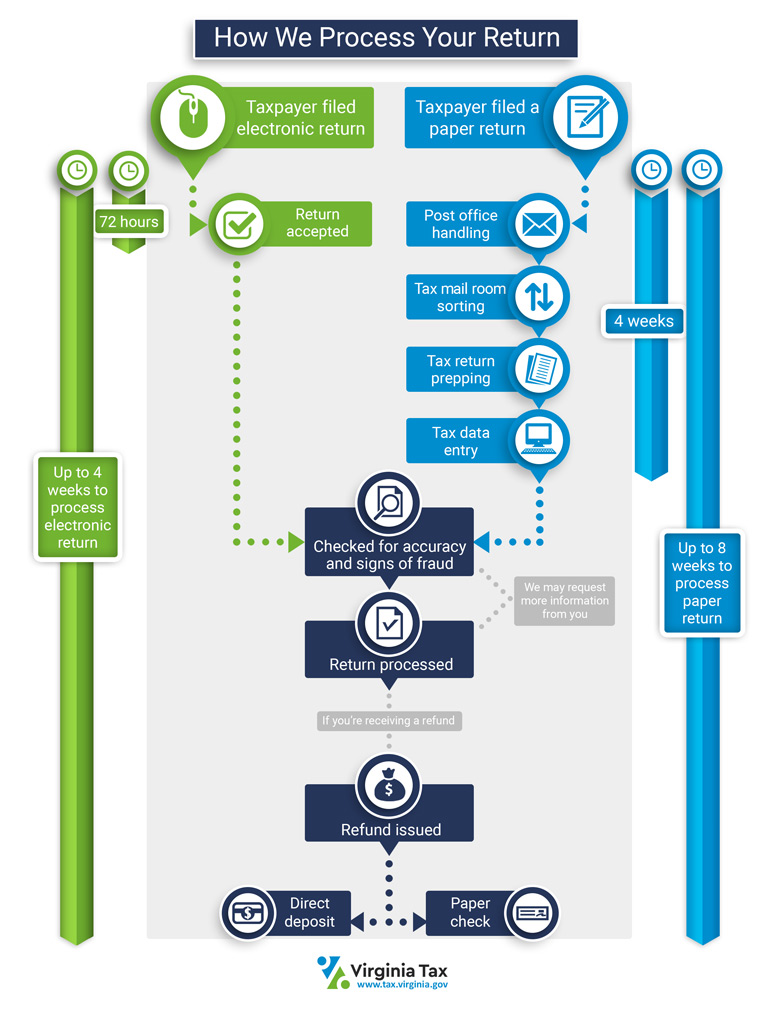

Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. However keep in mind the IRS tax refund schedule dates are an estimation and is not set in stone. The last tax year started on 6 April 2020 and ended on 5 April 2021.

Those who had already filed 2020 tax returns will be eligible for refunds on that amount.

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Irs Tax Refund Schedule 2021 Direct Deposit Dates 2020 Tax Year

Irs Tax Refund Schedule 2021 Direct Deposit Dates 2020 Tax Year

How To Go About Filing An Amended Tax Return E File Com

How To Go About Filing An Amended Tax Return E File Com

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

How Early Can You File Your Taxes To Get Your Tax Refund

How Early Can You File Your Taxes To Get Your Tax Refund

Where S My Refund Virginia Tax

Where S My Refund Virginia Tax

Where S My Refund Tax Refund Tracking Guide From Turbotax

Where S My Refund Tax Refund Tracking Guide From Turbotax

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

7 Essential Things To Know Before You File Your 2020 Tax Return

7 Essential Things To Know Before You File Your 2020 Tax Return

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.