Depending on your income level taxes can significantly lower your long-term total returns over time for REIT and BDC investments. For the top earners dividend tax rates can be as high as 37.

What Is A Dividend Reinvestment Plan Drip Robinhood

What Is A Dividend Reinvestment Plan Drip Robinhood

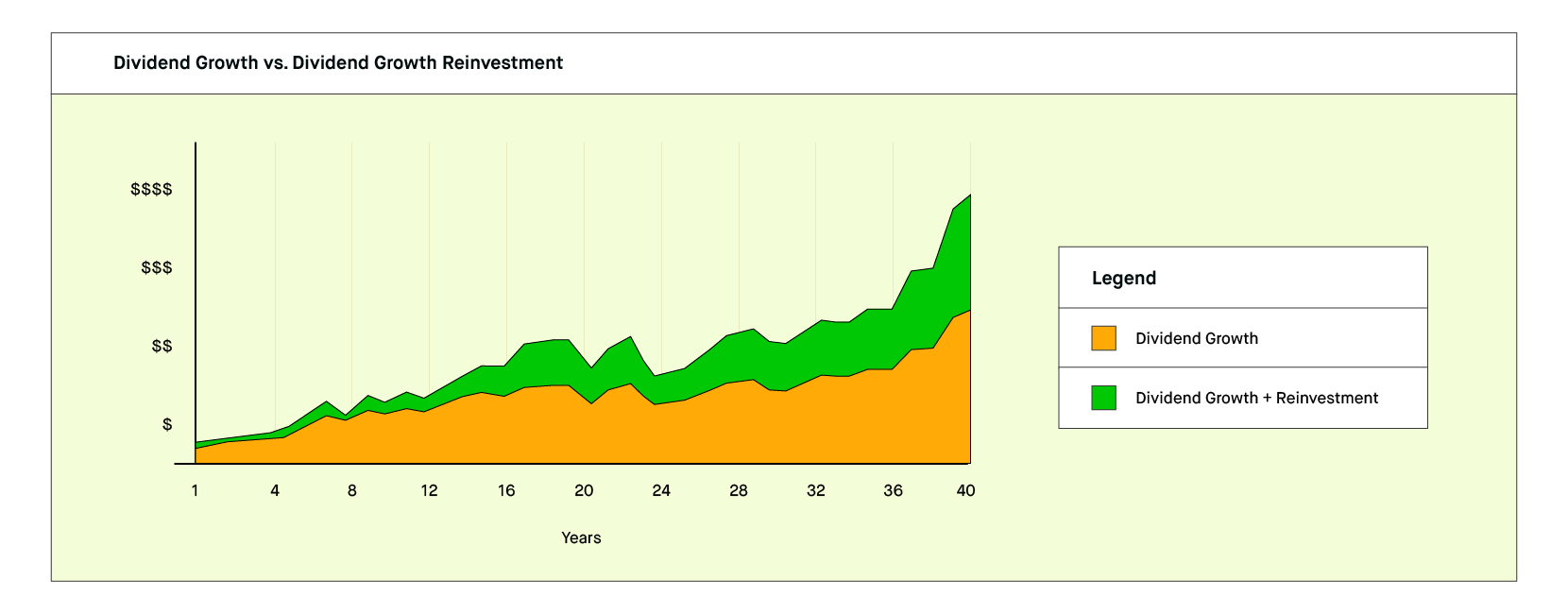

DRIPs allow the investment return from dividends to be immediately invested for the purpose of price appreciation and compounding without incurring brokerage fees or waiting to accumulate enough cash for a full share of stock.

Dividend reinvestment tax. Drip dividends are when EXISTING shares are given. Some of the most well-known publicly-traded. This was regardless of whether you chose to reinvest them or had dividends paid in cash.

The facility is usually run by an independent plan administrator. Dividend reinvestment plans Under a dividend reinvestment plan shareholders are offered the choice of using their dividend to acquire additional shares in the company instead of receiving a cash payment. If you dont add them to your cost basis you will end up overstating the capital gain.

200000 or more for single individuals. You also get a dividend allowance each year. A few caveats will help you understand whether YOUR dividends are taxable and how they are taxed if they are.

Dividend reinvestment plan is a variant of mutual funds wherein the dividend declared by the mutual fund is reinvested in the mutual fund. In a dividend reinvestment plan the dividend paid out is reinvested at the post dividend NAV of the fund. The investor must still pay tax annually on his or her dividend income whether it is received as cash or reinvested.

Even if you include the 38 net investment income tax for married couples filing jointly and who are earning 250000 or more 125000 or more for married couples filing separately. Mutual funds and other investment companies pay dividends to shareholders that are comprised on earnings the fund generates from trades involving the underlying securities. A dividend reinvestment plan DRIP is a plan under which a company almost exclusively public listed companies offers a facility for its shareholders to use their dividends to buy shares in the company.

What is a dividend reinvestment plan. Any reinvested dividends are after-tax dollars. Dividend reinvestment tax is dependent on the type of dividend.

For most Americans that equates to a 10 12 or 22 dividend tax rate which is also the rate at which reinvested dividends are taxed. Before April 2016 dividends were taxed differently. A company may offer a Dividend Reinvestment Plan DRIP which allows holders of ordinary shares to use their cash dividends to acquire additional shares.

A Dividend Reinvestment Plan DRIP is a vehicle that lets shareholders reinvest dividends in order to purchase full or partial shares of stock. These are purchased on their behalf by a. Ordinary dividends are taxed as ordinary income and include those paid on deposits with financial institutions tax-exempt organizations foreign corporations and capital gains distribution among others.

You need to declare all your dividend income on your tax return even if you use your dividend to purchase more shares - for example through a dividend reinvestment plan. And 250000 for a qualifying widow with a child this compares very favorably with the 37 top rate on ordinary income. The key tax issues you need to be aware are.

You do not pay tax on any dividend income that falls within your Personal Allowance the amount of income you can earn each year without paying tax. Suppose you invest 1000 in a stock add 200 in reinvested. The amount of tax paid on a qualified dividend depends on the income of the recipient.

Currently the maximum tax rate on qualified dividends is 20. Dividends are classified as either qualified or ordinary. A dividend reinvestment tax is paid by investors even if they never take physical possession of fund dividends.

Tax obligations when owning shares. For most C-corps such as Pfizer PFE Microsoft MSFT or ExxonMobil XOM these are qualified dividends meaning they are taxed as long-term capital gains 0 to 20 depending on your tax rate. Reinvested dividends are generally taxable like any other dividend but that doesnt necessarily mean youll incur a tax liability.

Rather than accepting these dividends as income some investors choose to reinvest the money in the fund in. Use the Dividend Reinvestment Plan DRPsDRIPs feature to track the impact of DRP transactions on your performance and tax Run powerful reports to calculate your dividend income with the Taxable Income Report portfolio diversity and Capital Gains Tax obligations Australia and Canada. However tax rates can.

Any dividends you earned were deemed to have been taxed at 10 before they were paid to you. In a dividend payout plan after the dividend is declared out of the funds profits the NAV of the fund reduces by a similar amount. If your taxable income is 0 to 40000 your tax rate on qualified dividends is.

The 10 deduction resulted. There are not taxable and do not get entered on the return. Dividend Reinvestment Plan Tax Treatment Although a DRIP allows you to be paid in shares instead of cash the IRS still treats your dividend as taxable income.

Dividend reinvestment tax Cash dividends are usually taxable even if investors reinvest that money automatically through their brokerage account or via the companys DRIP. These shares are usually issued at a discount on the current market price of the companys shares.

:max_bytes(150000):strip_icc()/diet-and-breast-cancer-risk-430445_v2-01-0ede322953b740aeb5078a444def535e.png)