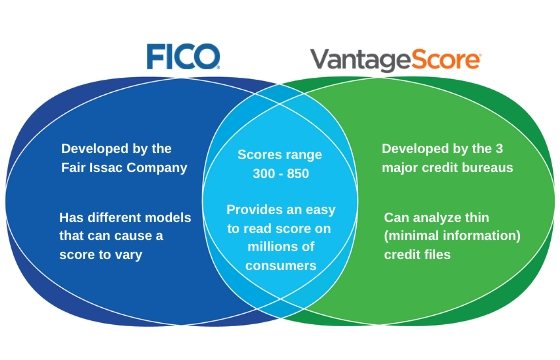

FICO Scores range from 300 to 850. The first versions of VantageScore 10 later 20 initially ranged between 500 990 which made the conversion from VantageScore to FICO almost impossible.

The Best Credit Score For The Multifamily Housing Industry

The Best Credit Score For The Multifamily Housing Industry

Yes there are differences between the two formulas but for the most part your score should be about the same either way said Matt Schultz chief credit analyst at LendingTree.

Vantagescore vs fico score. Ask The Experts. VantageScore vs FICO Score Range FICO score rages between 300 850. Both the FICO Score and VantageScore use a credit range of 300 to 850 with a higher number indicating greater creditworthiness.

Factors that go into your credit score. FICO Weighs late payments from all types of credit equally. Lets look at the key factors that these models use to calculate your scores.

While FICO used a credit range of 300 to 850 VantageScore chose 501 to 990. FICO Score 89 Credit scoring is a nuanced often opaque business. VantageScore and FICO criteria VantageScore and FICO credit-scoring models use data obtained from consumer credit reports to generate credit scores.

Since version 30 it has used the same 300 to 850 scale that FICO uses. This means that while FICO takes a snapshot of your credit situation at the time of the inquiry VantageScore looks at more of your data over time to identify patterns. A FICO score requires six months of credit history while a VantageScore requires only one month.

A VantageScore is a credit score jointly developed by the three major credit bureaus to predict how likely you are to repay borrowed money. 739 is a good credit score with both FICO and VantageScore. VantageScore is a newer credit-scoring model created by the three major credit bureaus as an alternative to FICO.

VantageScores consumer-friendlier model can issue credit scores to 30-35 million people considered unscorable by FICO. Similarly you may ask is Vantage score lower. The current VantageScore 30 was introduced in 2013 when they adjusted their scoring system to match FICOs range of 300 - 850 for credit scores.

At first VantageScore credit scores featured a different numerical scale 501 to 990. There are many documented differences between the two scores. The primary difference between the two is credit history.

A VantageScore gives you a little less time to shop around for rates. If you have a late mortgage payment your. In contrast VantageScore pays closer attention to your length of credit history and types of credit used compared to FICO.

We recommend Credit Sesame. You may come across either brand of credit score when you apply for financing like a credit card or a loan. In the interest of pulling back the curtain a bit we asked credit-industry executives for their take on VantageScore 30 including how it compared to the newest FICO model.

FICOs credit scores those developed by the Fair Isaac Corporation and VantageScore credit scores developed by the credit reporting agencies are both commonly used. VantageScore Places heavier penalties against late mortgage payments than with other types of credit. Many are unaware that recent changes can affect your score.

One major difference between VantageScore and FICO is that the former uses trended data to calculate your credit score. In reality you shouldnt get too hung up on whether youre getting a FICO score or a VantageScore. Compare this to FICOs good credit score rating which is a narrower range of scores from 670 to 739.

Similarly an excellent VantageScore credit score ranges from 781 to 850 while FICOs exceptional credit rating ranges from 800 to 850. Even if youre checking the FICO and VantageScore models that follow the 300-850 range each model has variations that make it difficult to compare apples to apples between the two. Initially the biggest difference between VantageScore and FICO Score was the scoring range itself.

FICO for example puts more weight on your current credit balances than VantageScore. 3 Another key difference. But the data may affect scores differently depending on which model is being used.

There are however some key differences in how the two scores are calculated including FICO giving more weight to payment history and VantageScores latest version emphasizing total credit usage and balances. VantageScore only requires one month of credit history and one account reported within the past two years. Credit bureaus Experian TransUnion and Equifax came up with the algorithm to produce VantageScore in 2006 competing against the better-known FICO scores.

.jpg?width=300&name=Recognize%20the%208%20Early%20Signs%20of%20a%20Pulled%20Back%20Muscle%20(1).jpg)